Posts Tagged "gas tax"

There’s a reason why Missouri voters twice rejected gas tax increases

Missouri spends more of its transportation budget on building new roads than maintaining its existing roads—23 percent of which are in poor condition. If it did a better job prioritizing maintenance, perhaps it wouldn’t need to ask taxpayers for a bailout. The state of Missouri gets over $1 billion a year from the federal government […]

South Carolina legislature overrides governor’s veto to increase state gas tax

Last week the South Carolina legislature voted to override a veto from the governor to successfully raise the state’s gas tax and other fees to increase funding for state highway projects. South Carolina is the 29th state to raise new transportation revenues since 2012.

Utah makes a bipartisan move to increase state and local transportation funding to help meet the demands of high population growth

Earlier this spring Utah became the third state in 2015 to pass a comprehensive transportation funding bill, raising the state’s gas tax and tying it to inflation. Unlike most other states acting this year, Utah raised revenues to invest in a variety of modes and also provided individual counties with the ability to go to the ballot to seek a voter-approved sales tax to fund additional local transportation priorities.

Congress kicks into high gear on transportation — let’s summarize the action

During an extremely busy week in the Senate in several key committees, a long-term transportation bill was introduced and approved, a bill to invest in and begin upgrading our nation’s passenger rail system was approved, Senate financiers continued discussing possible ways to keep our nation’s transportation fund afloat, and appropriators restored one cut to key transportation program made by the House — though not all, unfortunately.

House takes first step in process to keep the nation’s transportation fund solvent

For the first time since 2012, the House of Representatives held a hearing focused on funding the nation’s transportation system. Today’s hearing focused on the elephant in the room: how to adequately fund a transportation bill that’s longer than just a few months. While it’s a relief to see the funding issue finally getting airtime in the House, keeping the nation’s transportation fund solvent is only half of the problem — we also need to update the broken federal program that isn’t meeting our country’s needs.

Michigan ballot measure to raise transportation & education funds goes down by a large margin

A Michigan bill that would have raised new money and overhauled how the state pays for transportation was defeated by huge margin Tuesday with 80 percent of voters rejecting the complicated proposal.

Iowa was the first to successfully raise new state transportation funding in 2015 – and they did it with bipartisan support

Iowa in February became the first state in 2015 to pass a transportation-funding bill when legislators moved to raise the state’s gasoline and diesel taxes by 10 cents per gallon.

And then there were seven: April update on state transportation funding legislation

A total of seven states have now successfully passed legislation in 2015 to raise new money to invest in transportation, avoid budget shortfalls from declining revenue sources and keep up with growing needs — mostly by voting to raise their state fuel taxes.

‘Speak up for transportation’: Analyses show the devastating impact of federal cuts

Congress has seen various proposals floated to scale back federal investment in transportation, from cutting out transit funding to ending the federal gasoline tax and shifting full responsibility to the states. We decided to take a look at what that latter move would mean for taxpayers, who would have to make up the difference in each state or accept multi-million dollar decreases in funding and deteriorating conditions on an annual basis.

Update on 17 states moving to raise money for transportation

From Washington to South Carolina, 17 state legislatures (and counting) are debating plans to raise new revenue for transportation after a decade in which their primary funding sources shrank and federal support became increasingly uncertain. See the current state of play in our freshly updated national roundup.

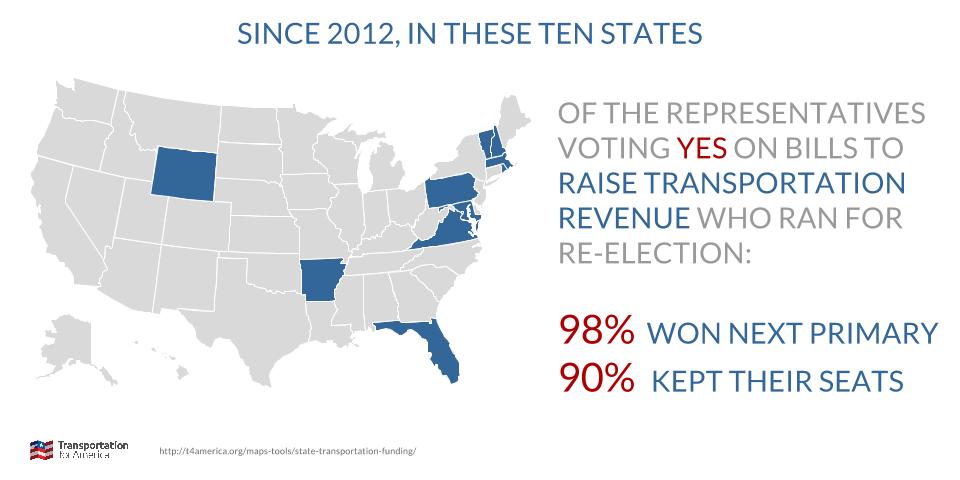

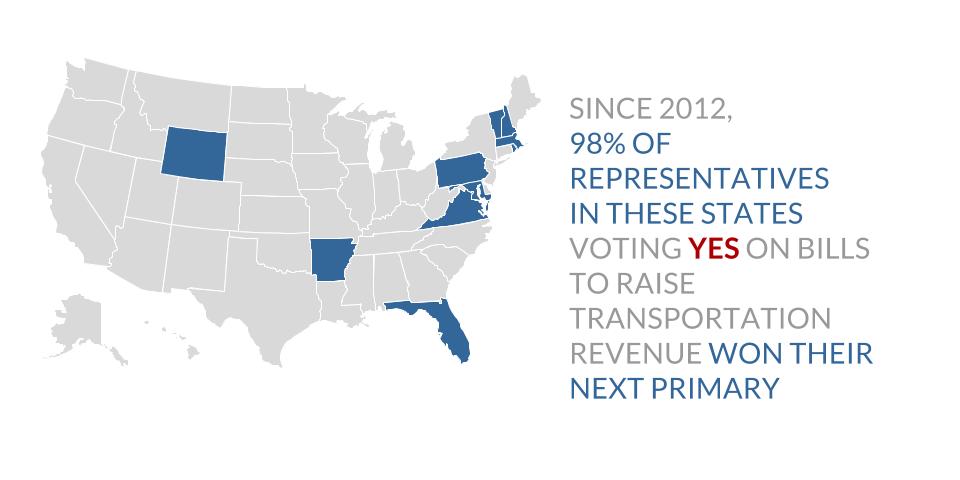

Voters overwhelmingly re-elect candidates who raise transportation revenue, analysis of general election results shows

Continuing a trend observed in the primaries, an updated T4America analysis of November’s election data shows that, since 2012 in ten states that passed legislation to raise new transportation revenue, 90 percent of the supportive legislators retained their seats — knowledge that should be instructive for the legislators in 17 states now considering similar plans to raise state transportation revenue in 2015.

Rep. Blumenauer introduces plan to raise the federal gas tax

Supported by 23 cosponsors in the House, a representative from Transportation for America and a plethora of national construction, transportation and labor groups, Rep. Blumenauer and Rep. Welch introduced the UPDATE ACT (HR 680) to increase the federal gas tax by 15 cents over three years and index it to the inflation.

15 issues to watch in ’15, Part I: Capitol Hill developments

Already, 2015 feels like it could be a big year for transportation, at the federal, state and local levels alike. As the year began, we thought it would be fun to identify 15 people, places and trends that seemed to be worth keeping an eye on the next 12 months. In some years, 15 would be a stretch, but this year we had a tough time whittling the list to match the number of the year.

Tell the President to back a bipartisan gas tax increase

The steep drop in gas prices offers the best opportunity in years to raise the revenue we need to rescue our transportation trust fund and build for the future. And, for the first time in recent memory, leaders in both parties are calling for a gas tax increase to avoid foisting monumental repair and construction bills on the next generation.

GOP Rep. Petri joins bill to raise the federal gas tax

The Highway Trust Fund, our nation’s key infrastructure funding source, has been teetering on the edge of insolvency for the past few years, with legislators from both parties unable to secure a long term funding source.

Massachusetts vote a bellwether for efforts to raise state transportation revenue

In 2013, the Massachusetts legislature came together on an ambitious plan to necessary revenues for transportation, passing a three-cent gas tax increase as well as indexing it to inflation. In what makes this one of the most interesting ballot measures to watch, just a year after the legislature approved it, voters on Nov. 4 will decide whether or not to repeal part of the package.

Vermont, New Hampshire, Massachusetts follow the trend: voters support transportation revenue increases

As voters have been proving over and over during primary season this year, raising taxes or fees for transportation isn’t a political death sentence – no matter the party or political affiliation. In the past two weeks, Vermont, Massachusetts, and New Hampshire’s state legislators faced their first primary since voting to pass bills to raise additional revenue for much needed transportation and infrastructure projects.

A dozen states have moved to raise transportation dollars, with more to come: Track them here

With Congress continuing to flail on providing stable funding, many states are finding they can’t wait and are moving on their own. But it’s not always as simple anymore as adding pennies to a per-gallon gas tax, so states are taking some creative approaches. You can learn about what 12 states already have done – and the political fall-out from it – with our revamped and refreshed tracker. You’ll also see what’s brewing in still more states.

Follow-Up: Maryland pols raise their gas tax, voters respond supportively

While the conventional wisdom is that voting for a tax increase spells doom for a politician, recent evidence from Maryland continues to show that state politicians rarely lose their seats when they vote for a gas tax hike.

House proposes a trust fund Band-aid through May, 2015, with key differences from Senate

A House proposal to shore up the transportation trust fund through May, 2015, is a good news, not-so-good news proposition. Late yesterday, House Ways and Means Chairman Dave Camp (R-MI) proposed a $10.8 billion infusion to cover a looming deficit in the Highway Trust Fund. The money for the next few months would come mostly […]