Last week’s election saw significant support for transit. While some of the larger local transportation ballot initiatives failed, voters approved the overwhelming majority of transit funding measures—several by a large margin. Here’s a rundown on how transportation ballot initiatives fared from Austin, TX to Wheeling, WV, and every place in between, updating our earlier blog.

The Mountain Line bus service in Missoula, MT. Photo courtesy of Mountain Line.

It wasn’t just the next president of the United States or the balance of power in Congress on the ballot last week: voters across the country decided on the future of transportation in their hometowns. From forward-looking proposals for transit expansion and renewals of existing transportation funding, here’s what passed and what failed on this extraordinary, pandemic Election Day. In short, it was a pretty great day for public transit funding.

(Before diving in, don’t miss our summary of how transportation ballot initiatives fared during the spring and summer primary elections. While some regions and states opted to delay or cancel ballot measures due to COVID uncertainties, a number of initiatives moved forward in the primaries, and the vast majority passed.)

One win, two losses: three big transit measures

PASSED (58%-42%): Voters in Austin, TX passed the first phase of Project Connect, a package of transit investments totalling $10 billion. This initial phase includes increasing property taxes to raise $3.85 billion and leverage federal funds for a total of $7.1 billion. As our colleague Rayla Bellis wrote a few weeks ago, the proposal includes new light rail lines, a tunnel for light rail in the downtown area, expanded bus routes, a transition to electric buses, and bus rapid transit service. It also includes $300 million for transit supportive investments, anti-displacement efforts and affordable housing along the proposed lines.

This win comes in the wake of Austin’s history of unsuccessful initiatives to fund light rail expansion. Project Connect was unanimously approved by the Austin City Council yet faced some opposition, both in response to the cost and relative permanence of new light rail lines compared to improved bus service.

FAILED (43%-57%): Voters rejected Portland, OR’s Let’s Get Moving measure (Measure 26-218), which would have levied a 0.75 percent payroll tax on businesses with more than 25 employees. The business community largely withdrew support for the measure, with a number of larger businesses contributing to a successful opposition campaign.

With the $4.2 billion generated by the payroll tax and an additional $2.84 billion in matching funds, the measure would have funded dozens of light rail and bus transit expansion and safety projects for people walking and biking along identified priority corridors. It also included funds for anti-displacement work in predominantly Black and brown communities along the corridors.

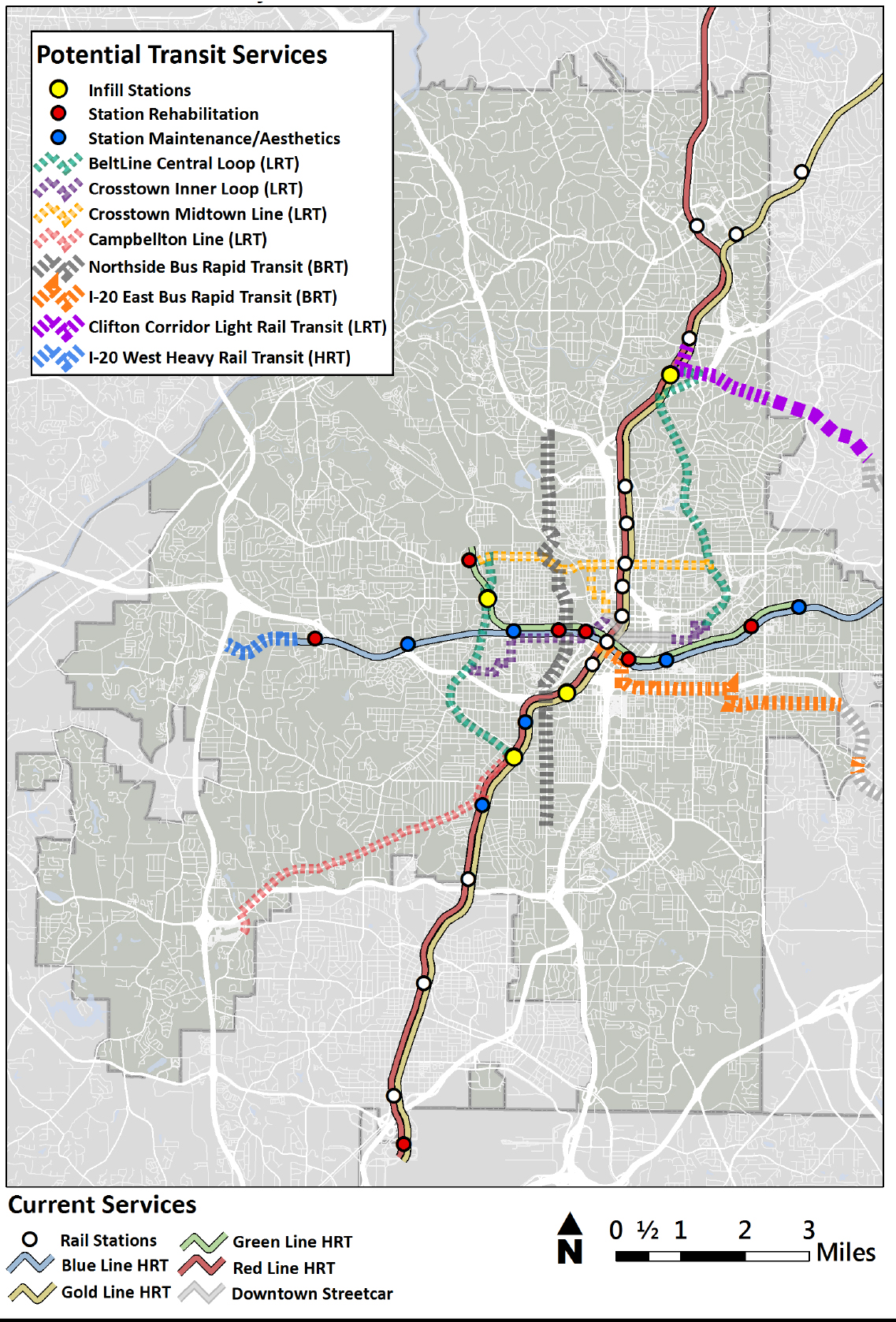

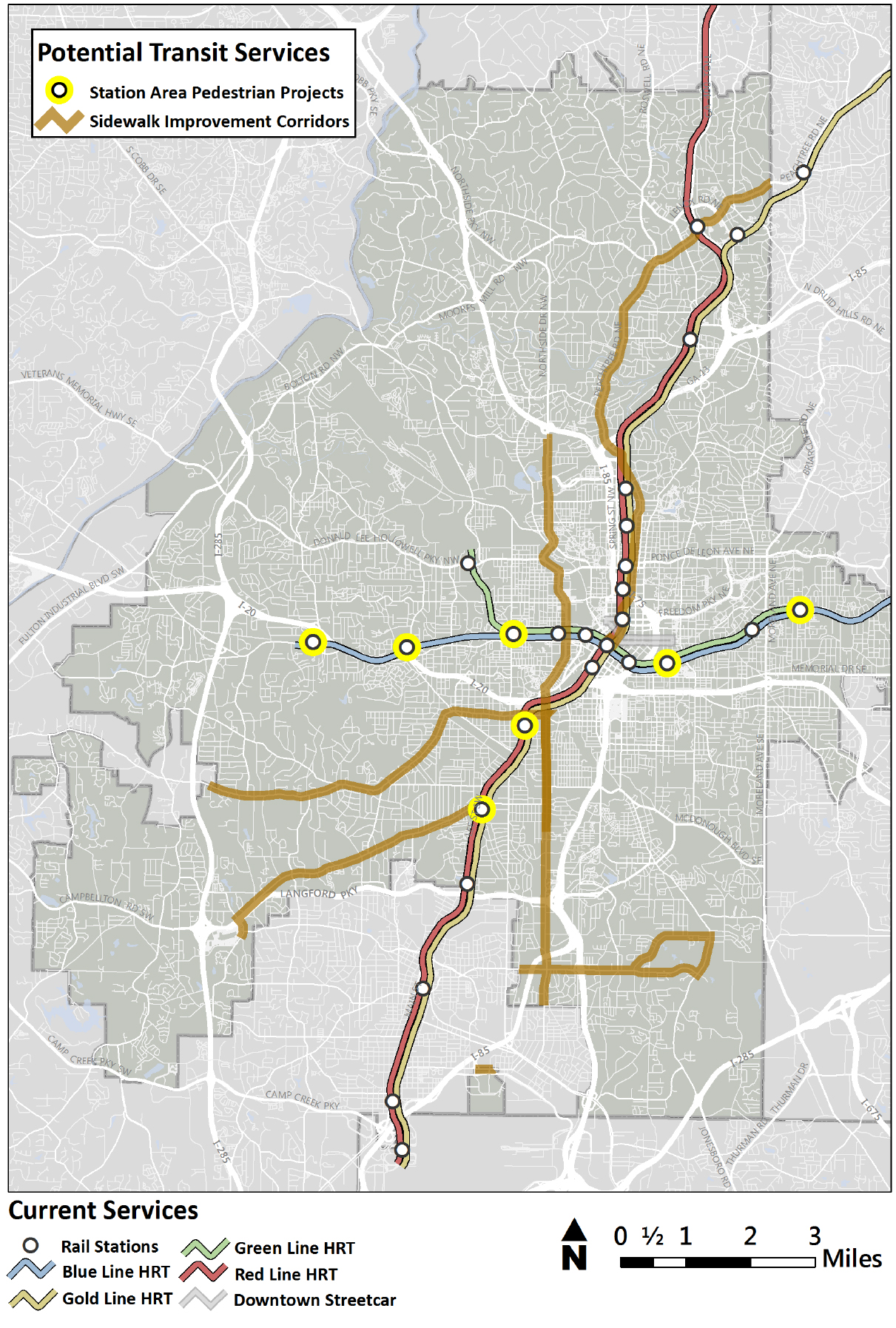

FAILED: In suburban Gwinnett County, GA in the Atlanta region, residents rejected a proposed 30-year, 1 percent sales tax for transit expansion in the county that would raise a total of $12 billion for bus and rail expansion. This rejection—failing by only a margin of approximately one thousand “no” votes, although a recount might be possible—comes less than two years after a failed measure to fund transit expansion for both Gwinnett County bus and MARTA rail that would also have integrated Gwinnett County transit into the MARTA regional transit system—a change that county voters have rejected several times over the past few decades.

Other local and state initiatives of interest

PASSED (82%-18%): Voters in Seattle, WA decided to renew funding for the Seattle Transportation Benefit District via a six-year 0.1 percent sales tax and a car-tab fee that expires this year. The plan will reduce total service below existing levels, but it will focus the remaining service more heavily in communities of color. The measure would generate $20 to $30 million annually over six years.

PASSED (61%-39%): Voters in three small municipalities in Gratiot County, MI passed a 1-mill levy (one dollar per $1,000 dollars of assessed value) to join their region’s Alma Transit system. The St. Louis and Ithaca city councils and the Pine River Township board all voted unanimously over the summer to put the measure on the ballot.

PASSED (59%-41%): Missoula, MT voters approved a property tax increase to expand Mountain Line bus service frequency, help fund the area’s zero-fare program, and support conversion to an electric bus fleet.

FAILED (45%-55%): Newton County, GA’s proposal for a 1 percent Transportation Special Purpose Local Option Sales Tax for transportation was rejected by voters. Revenues would have been shared among the cities located within the county using a formula, and each city would have decided how to allocate its funds.

PASSED (70%-30%): Voters in the Bay Area, CA passed a 1/8 cent sales tax to provide dedicated funding for the region’s commuter rail, Caltrain. The tax is expected to generate an estimated $108 million annually, which will help provide a lifeline for the rail line as it faces the possibility of a shutdown during the pandemic due to low ridership.

WITHDRAWN: Residents of North Carolina were set to vote on a $1.15 billion bond measure to fund the construction and renovation of highways, roads, bridges, and related road infrastructure. The measure also included $1.95 billion in education bonds, but it was withdrawn.ALL PASSED: Voters passed measures to renew existing transportation and transit funding in the State of Arkansas (passed), Bellingham, WA (passed), Monroe, MI (passed) and Wheeling and Bethlehem, WV (passed). Similar renewals largely also passed in 2020 despite COVID uncertainties, as we covered in a blog earlier this fall.

Utah’s legislature acted earlier this year to increase the state’s gas tax, tie it to inflation, and provide individual counties with the ability to go to the ballot to increase sales taxes to fund additional local transportation priorities. As of this writing, 17 out of 29 Utah counties have decided to put those measures on their ballots.

Utah’s legislature acted earlier this year to increase the state’s gas tax, tie it to inflation, and provide individual counties with the ability to go to the ballot to increase sales taxes to fund additional local transportation priorities. As of this writing, 17 out of 29 Utah counties have decided to put those measures on their ballots.

Though more than

Though more than