Pew: “Self-sustaining” highways are increasingly subsidized

Critics of public transportation often cling to the canard that government should not subsidize a transportation option that cannot pay for itself. These naysayers reference “self-sustaining” roads and highways, which receive funding from user-fees – in this case, the federal gas tax.

Critics of public transportation often cling to the canard that government should not subsidize a transportation option that cannot pay for itself. These naysayers reference “self-sustaining” roads and highways, which receive funding from user-fees – in this case, the federal gas tax.

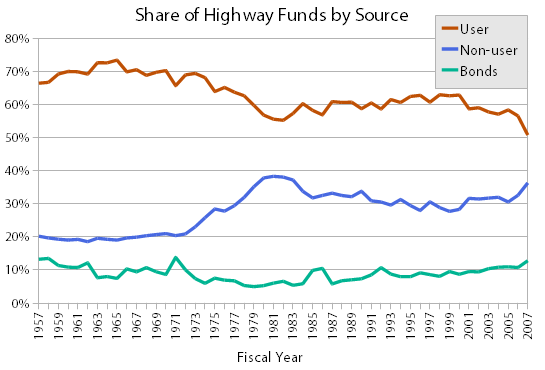

A new study conducted by SubsidyScope, an initiative of the Pew Charitable Trusts, reveals that not only are roads and highways not self-sustaining, but the amount covered by gas taxes has been declining — leaving an increasing amount of their massive cost to be subsidized. Pew projections – using Federal Highway Administration numbers – show user fees contributing a slim majority of the revenue to the Highway Trust Fund, with the difference made up through bonds and General Fund dollars. Public transportation does, as the critics assert, operate “at a loss,” but so do roadways (see chart below, courtesy of Subsidyscope).

The researchers wrote: “In 2007, 51 percent of the nation’s $193 billion set aside for highway construction and maintenance was generated through user fees — down from 10 years earlier when user fees made up 61 percent of total spending on roads. The rest came from other sources, including revenue generated by income, sales and property taxes, as well as bond issues.” Forty-years ago, they noted, user-fees generated 71 percent of highway revenues.

Of the 18.4 cent federal gasoline tax, 2.86 cents – about 15 percent – is directed toward mass transit projects, and an additional 0.1 cent toward environmental clean-up, according to the report. That leaves more than 80 percent strictly for highways. Even if we spent 100 percent of gas tax revenues on highways, only 65 percent of their total cost would be covered. There would still be a need for significant outside revenue – in other words, subsidies. Does that mean highways are “government waste?” Or are transportation dollars an investment to provide access to jobs and movement of goods?

One reason for the decline of the user-fee’s contribution is that the gas tax has not kept pace with inflation. Today, there is limited political appetite for a gas tax increase. Americans are also driving cleaner cars than they used to, due in large part of federal action on fuel economy. Less gas purchased means lower gas tax revenues.

So, to the critics who seem to be against all subsidies — unless they’re going to cover highway projects: let’s drop the claim that highways “pay for themselves” and have a debate rooted in fact rather than myth.

2 Comments