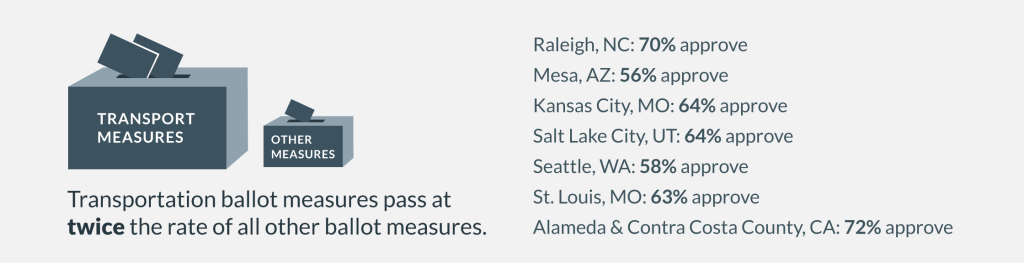

Despite the defeat Tuesday of some high-profile measures, transportation funding asks continue to be approved at very high rates – and a few key wins may have impact for years to come.

While some of the key measures we were tracking did not fare well, on the whole, transportation (and transit specifically) did well at the ballot box (See the full list of measures we’re tracking below.) According to the Center for Transportation Excellence’s final results, 72% of all transit or multimodal measures were approved this year, including yesterday’s results – similar to the trend of recent years.

One of the most significant measures at the state level was considered in Massachusetts, where voters were deciding whether or not to repeal a legislature-approved provision to index the gas tax so revenues could keep up with inflation and allow the state to keep up with their pressing transportation needs. The measure to repeal was approved, albeit at a fairly close margin (52.9-47%), which means that Massachusetts will lose a portion of their new funding for transportation, but not all — they also raised their gas tax by three cents, but that was unaffected by this ballot measure.

The Massachusetts vote was definitely one that other states were watching closely as a potential bellwether for attempts to raise new revenue elsewhere. As Dan Vock at Governing Magazine wrote today, “That is not good news for transportation advocates, who are looking for politically feasible ways to raise money for infrastructure improvements.” Though a handful of other states did succeed in raising their gas taxes over the last couple of years, it’s possible that more states hoping to raise revenues in the next few years will consider a shift away from the per-gallon tax to a sales or wholesale tax (as Virginia and Maryland did for example) rather than trying to add in automatic indexing, which many voters saw negatively in Massachusetts.

Rhode Island voters approved a statewide ballot measure to fund some pretty significant transit improvements across the state, including new transit hubs to connect their popular passenger rail services with buses and other forms of transportation, and improvements to the statewide bus network. Scott Wolf, the executive director of Grow Smart RI, which ran the campaign on the measure, was full of praise today:

We commend our fellow Rhode Islanders for recognizing that these investments will provide benefits far beyond their costs and make it easier for the state to retain and recruit a young, talented and mobile work force. If we can continue to pursue this kind of asset based economic development strategy under Governor-Elect Raimondo, we at Grow Smart RI are confident that Rhode Island’s best days will still be ahead of us.

At the local and regional level, there was perhaps no more significant symbolic vote than the one taken in metro Atlanta yesterday. For the first time in more than 40 years, Atlanta’s MARTA system will be expanding into a new county, as Clayton County, Georgia overwhelmingly approved (73% in favor) a one-percent sales tax increase to join MARTA, expand bus service into the county, and save half of the projected revenue for planning and implementing a possible rail connection into the county.

Clayton was the only one of Atlanta’s five core counties that lacked a local public transit system, and there was a surge of momentum for this referendum after a limited county bus system folded in 2010. When it did, Clayton State University saw a drop in enrollment and scores of jobs at Atlanta Hartsfield-Jackson Airport got much harder to reach for county residents.

From a regional perspective, with more of the region now having a stake in MARTA — it was intended to serve all five metro counties when it was created, but only two opted in — the agency will expand their base of users and bring more local officials to the table who care about seeing it succeed. And the resounding vote of support with local dollars will likely help continue develop support from the state legislature, where MARTA CEO Keith Parker has been hard at work to create allies for the only major transit agency that receives no dedicated funding from the state.

The news was not so good one state further south, where Pinellas County, Florida (St. Petersburg/Clearwater) saw their Greenlight Pinellas referendum roundly defeated, with only 38% in favor. (A smaller similar measure was also defeated in Polk County, to the east of Tampa.) The referendum would have made enormous expansions to their existing bus service, added new bus rapid transit corridors, and begin laying the groundwork for light rail running through the spine of the county.

It’s a blow not just for Pinellas County, the most densely populated county in the state, but also for the Tampa region at large. Business and civic leaders were hoping that Pinellas would take a first step that Tampa would follow in 2016 with a measure of their own, as they stitch together a region with two major cities divided by the bay. Pinellas leaders can take heart, however, in the fact that many places have lost their first (or even second) run at an ambitious ballot measure, before winning in the end.

We’ll be back shortly with a look at some of the national and state candidate races, and the implications of all the moves in Congress will have on the precarious nature of the nation’s transportation fund, and the upcoming reauthorization of MAP-21 in 2015.

State

Massachusetts – Question 1 to repeal state’s new funding for transportation

Result: Measure Approved (52.9% – 47.1%)

T4A summary: Massachusetts vote a bellwether for efforts to raise state transportation revenue

Rhode Island – Question 6 transit bond measure

Result: Measure Approved (60% – 40%)

T4A summary: Rhode Island’s first statewide ballot measure to support transit

Wisconsin – Question 1 for transportation funding

Result: Measure Approved (79.9% – 20.1%)

T4A summary: Voters in two states consider measures to restrict funding to transportation uses

Maryland – Question 1 on transportation funding

Result: Measure Approved (81.6% – 18.4%)

T4A summary: Voters in two states consider measures to restrict funding to transportation uses

Texas – Proposition 1 to direct rainy day funds into highways

Result: Measure Approved (79.8% – 20.2%)

T4A summary: Texas looks to voters to ensure billions in highway funding

Louisiana – State infrastructure bank

Result: Measure Defeated (67.5% – 32.5%)

Local

Clayton County, GA – One percent sales tax to join MARTA and re-start bus service

Result: Measure Approved (74% – 26%)

T4A summary: After spurning it for decades, suburban Atlanta county seems poised to join regional transit system

City of Seattle, WA – Proposition 1 to add a 0.1% sales and use tax to prevent bus cuts

Result: Measure Approved (59% – 41%)

Austin, Texas – Proposition 1 for $600 million bond for light rail

Result: Measure Defeated (43% – 57%)

Pinellas County, Florida (St. Petersburg) – Greenlight Pinellas for improving transit service & adding light rail

Result: Measure defeated (38% – 62%)

T4America summary: Leaders say St. Petersburg measure key to economic success

Alameda County, CA – Measure BB for a half-percent increase in sales tax to fund local transit and transportation projects

Result: Measure Approved (70% – 30%)

Gainesville, FL (Alachua County) – 1% sales tax for a range of transportation improvements

Result: Measure Defeated (40% – 60%)

Though more than

Though more than