State DOTs: Who they are and why they matter

State departments of transportation (DOTs) have the primary role in shaping the priorities of our nation’s transportation systems. They are responsible for directing hundreds of billions in federal and state transportation dollars to transportation projects. Congress gives states near-total flexibility to spend federal money however they see fit.

Where does their money come from?

State DOTs receive funding from the state and federal government (via USDOT). The ratio of federal to state funding varies from state to state and year to year, with some states receiving more or less funding from their state government than from the federal government. Learn more about the current federal funding framework, the IIJA.

About 87 percent of the federal money state DOTs receive comes from formula funds. These funds are highly flexible and can be used for almost any project. While most state DOTs do not use this flexibility, these funds can be used to build, expand, repair, redesign, shrink, or take down roads; build transit, buy buses, improve transit maintenance facilities; or provide facilities for greater safety to vulnerable travelers like people walking, biking and rolling. The federal government has no role in directing this funding except to ensure projects are eligible for funding and comply with federal rules like environmental regulations and civil rights laws.

State funding sources often include gas taxes, licensing fees, tire fees, and highway tolls, but these revenues only provide a portion of state DOTs’ funding. In 2020, state and local governments provided 75 percent of highway and road funding, while the remaining 25 percent came from federal transfers. In the coming years, this trend is expected to shift as IIJA funds are utilized.

General funds are highly flexible and can be used for a range of purposes supporting a state’s operations.

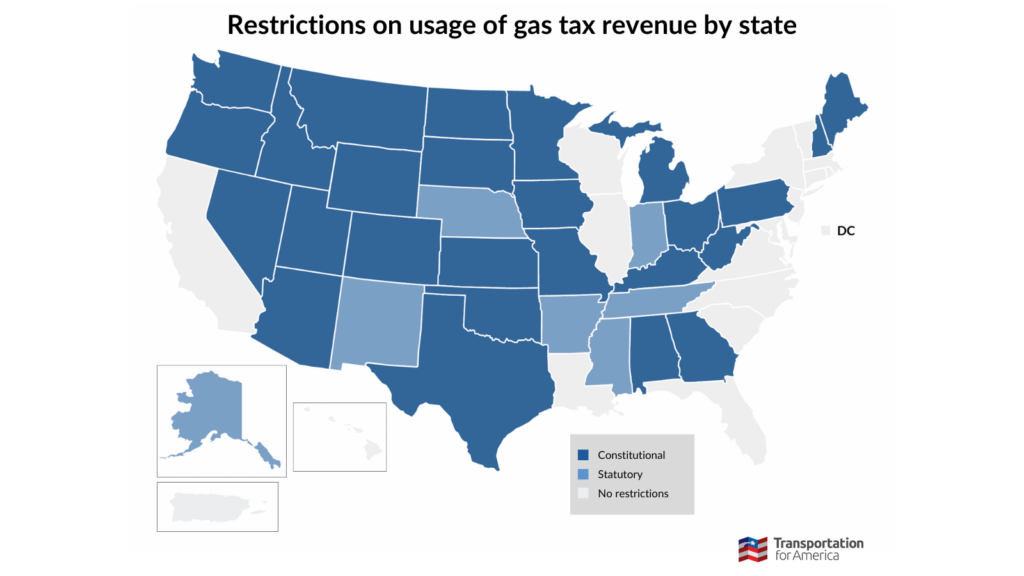

Revenue from gas taxes, tolls, and fees can be more restricted. For example, many states have laws prohibiting the use of gas tax revenue on transit projects.

How do state DOTs decide where all that money goes?

State DOTs compile a State Long Range Transportation Plan (SLRTP) outlining their transportation needs, goals, and actions over the next 20 or more years. Then they compile a Statewide Transportation Improvement Program (STIP) which is a list of all the projects the state plans to fund over the next 4 years, based on the long-range plan. Two external factors can influence state DOT decision-making:

1. State government guidance

- State DOTs take their direction in choosing and implementing projects from their governors and state legislatures. Some state legislatures have oversight committees specifically for the state DOT.

- Many DOT directors are appointed by the state’s governor and confirmed by the state legislature. Some states, like Virginia and California, also have transportation commissions made up of appointed commissioners who oversee the agency. The state of Mississippi directly elects its DOT commissioners.

- State legislatures can further guide DOT decision-making by earmarking funds for specific purposes or passing legislation that directs the consideration of certain factors, such as Washington’s Complete Streets law or legislative and constitutional prohibitions against using gas taxes for transit.

- State DOTs can have an additional layer of oversight from the state’s executive branch, a transportation commission board appointed by the governor. The executive board can influence state DOT operations directly through specific projects or indirectly through policy-impacting project programming.

2. Federal oversight

- The federal government has no role in directing federal transportation funding except to ensure projects are eligible for funding and comply with federal rules like environmental regulations and civil rights laws. Federal funds are distributed according to the law in Title 23 of the US Code. Congress authorizes this program every 5-6 years, most recently in the bipartisan infrastructure law in 2021. Read more about this law here.

- Each state DOT has an operating agreement that governs its formula funds. These agreements are slightly flexible, accounting for individual state laws that dictate oversight responsibilities. States spend money on transportation needs and apply for reimbursement so that USDOT can determine whether the law has been complied with.

- Occasionally, the Federal Highway Administration will conduct an audit to ensure DOTs are complying with their operating agreement.

Community Connectors: tools for advocates

You may be fighting against a freeway expansion. You may be trying to advance a Reconnecting Communities project to remove an old highway. You might be just trying to make wide, dangerous arterial roads a little safer for people to cross. This Community Connectors portal explains common terms, decodes the processes, clarifies the important actors, and inspires with helpful real-world stories.

You may be fighting against a freeway expansion. You may be trying to advance a Reconnecting Communities project to remove an old highway. You might be just trying to make wide, dangerous arterial roads a little safer for people to cross. This Community Connectors portal explains common terms, decodes the processes, clarifies the important actors, and inspires with helpful real-world stories.