Congress has suggested that they may focus on infrastructure in an upcoming stimulus bill. It’s not entirely clear what Congress will do—or if spending on infrastructure is the right way to stimulate the economy right now—but if Congress does want to pass an infrastructure package, they should stop spending money like it’s 1982.

Upset about this broken status quo? Sign our petition urging Congress to fund public transit and highways equally.

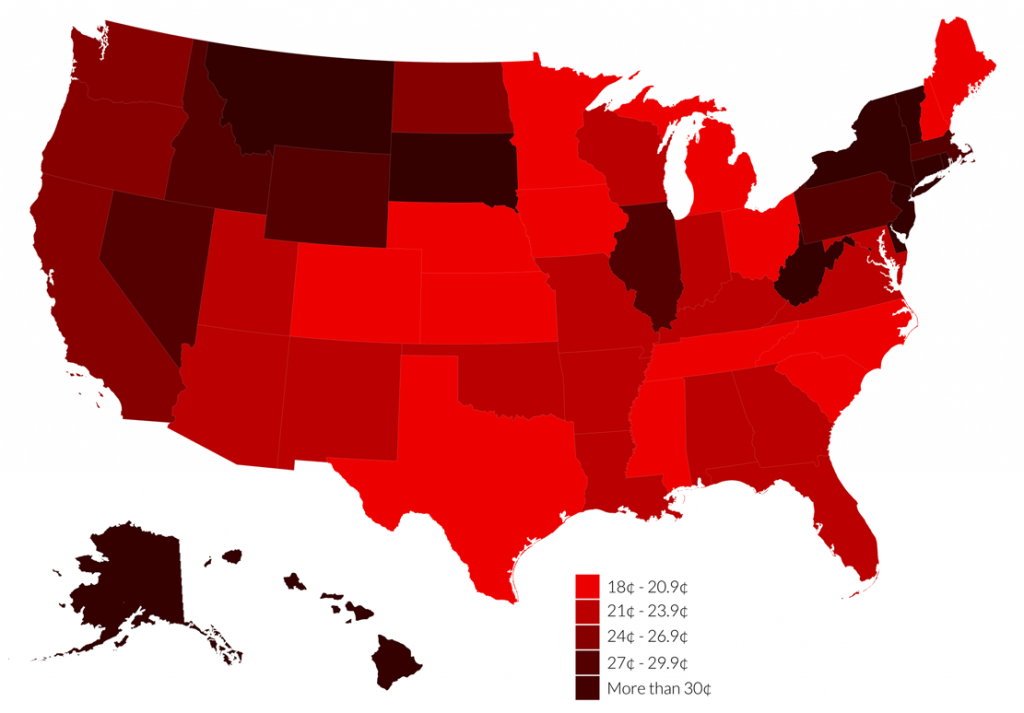

For decades, the U.S. has funded transportation based on the idea that the user pays for the infrastructure through a fee—the gas tax, which has filled the Highway Trust Fund since 1956. In 1982, Congress struck a deal to raise the gas tax, but 1 cent of the 5 cent increase would be dedicated to transit, with the remaining spent on highways. This established the infamous “80-20 split” in transportation spending: highways get 80 percent of funds, and transit only gets 20 percent (though in reality, transit gets much less).

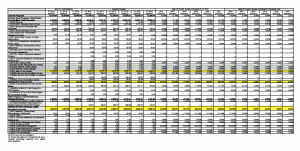

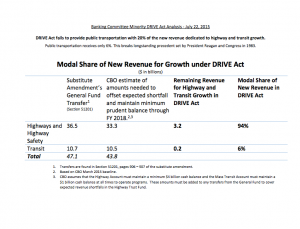

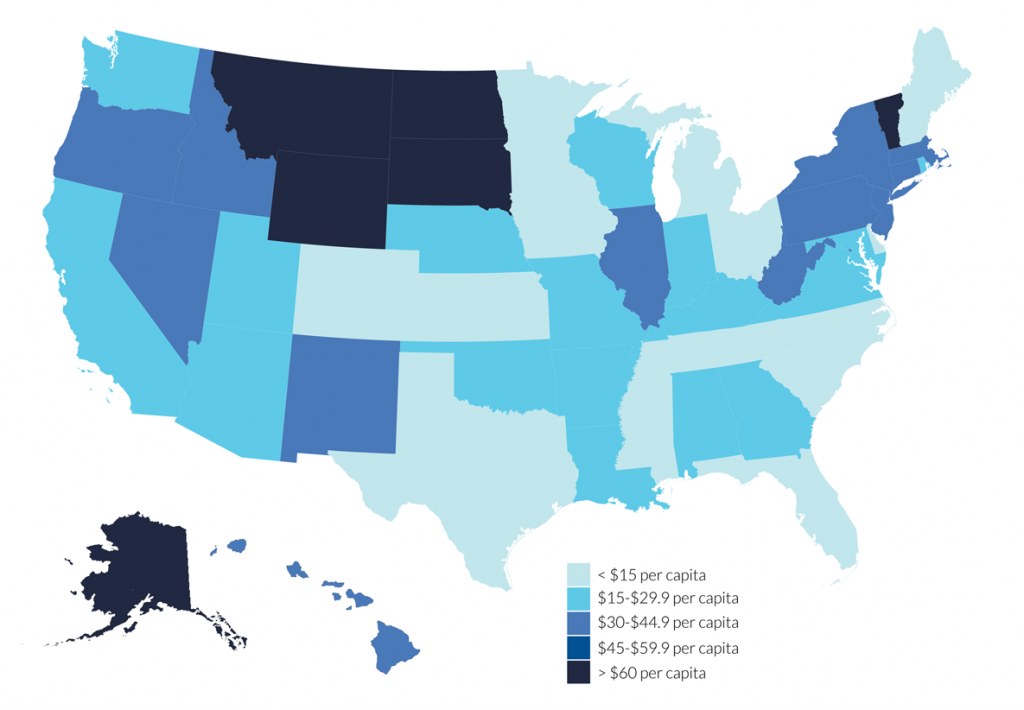

Since then, transportation spending has essentially stayed the same. In the most recent spending bill, Congress appropriated $48.6 billion for highways and only $10.2 billion for transit. But the entire logic behind highways receiving a substantially larger portion of the pie—i.e. drivers were paying for it—came crashing down in 2008, when the trust fund ran out of money because the gas tax was no longer sufficient to cover expenditures. To stay afloat, the trust fund has received huge infusions of general taxpayer dollars totaling $144 billion.

Our transportation dollars are no longer based on a user fee paid by drivers, yet the 80-20 funding split persists. This no longer makes any sense. Even the influx of transportation funds from the Recovery Act in 2009 all came from deficit spending from the general fund—not a single dime came from gas tax user fees—yet the vast majority of funding (roughly 75 percent) went to roads.

Why should we continue to honor a nearly 40-year old system based on a nearly defunct user fee? If Congress pursues an infrastructure package or reauthorization as part of a stimulus bill, it will be wholly outside a user fee construct. Considering that, why shouldn’t transit receive more than 20 percent of transportation dollars? Why shouldn’t transit receive 80 percent or even 100 percent of transportation dollars? We are not saying that other modes should not receive any money. The point is that all assumptions should be questioned and funding should go to projects that create jobs quickly in a stimulus bill and support today’s needs and goals, not those of 40 years ago.

It’s time for Congress to abandon this obsolete, untenable split in transportation funding.

Congress has already upended status quo

Whether legislators realized it or not, the recently passed $2 trillion CARES Act has already disrupted the status quo to deal with immediate needs. The act includes $25 billion in direct, emergency assistance for transit at a time when revenue is plummeting. That’s more than double what the federal government usually spends on transit in a year. Normally, transit agencies have been barred from using federal funds for operations, typically only providing funds for maintenance and capital (like building new stations, or buying new buses).

With the passage of the CARES Act, Congress broke with precedent and provided essential funding for transit operations. But we should go further, and end the baseless 80-20 funding split. After all, this pandemic has made it obvious that transit is essential, and it should be funded as such.

With 2.8 million essential workers relying on transit to get to their jobs and countless others depending on it to access food and health care, we need transit to be robust, reliable, and frequent. And we’ll need transit to get tens of millions more people moving once this virus is contained. But giving transit only 20 percent of the pie just won’t cut it.

According to the Federal Transit Administration, our transit systems face a $98 billion backlog in deferred maintenance. Unlike the road maintenance backlog which has more to do with state DOTs prioritizing new roads instead of maintenance, the transit backlog is due to insufficient funding. There is also great demand for more transit capital funding, and operating support will be critical to ensure that agencies can continue to provide this invaluable service and limit crowding.

We have underfunded transit for decades, and doing so has left too many communities with deteriorating systems and infrequent, unreliable service. It’s time to get rid of the 80-20 split. To get through this crisis and build a robust economy again, we’ll need to fund transit equitably and treat it like the vital public good that it is.