After two days of hands-on expert advice — and hopefully some inspiration and encouragement — state and local leaders from all over the country are returning home from our second Capital Ideas conference better equipped to advance creative and innovative transportation funding and policy reforms to make the most of limited infrastructure dollars.

Smart Growth America president and CEO Geoff Anderson kicking off Capital Ideas in Sacramento, CA on November 16, 2016

For two days in Sacramento, more than 50 speakers interacted with 200-plus smart, passionate leaders helping their states take a different path when faced with dwindling transportation revenues or outdated, 1950’s policies that are ill-equipped to solving the complicated, multimodal challenges that local communities face today.

We heard from state DOT officials doing impressive things to save money and spend it more effectively. We heard from state legislators who’ve rolled up their sleeves and raised new revenues for transportation. We heard from experts at nearly all levels of government who are thinking about the future of technology and the ramifications for the communities we call home.

And we heard from a red-state republican state legislator who detailed his journey from transit skeptic to believer in a keynote on the second day of Capital Ideas.

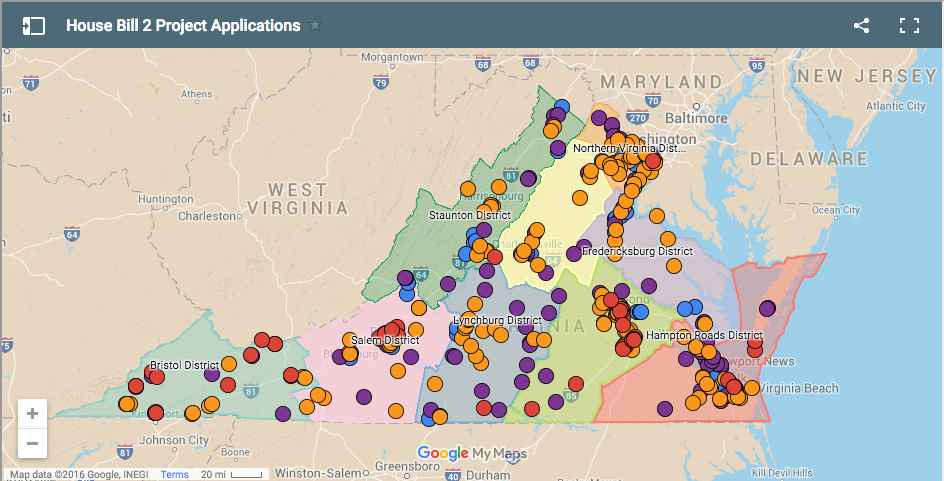

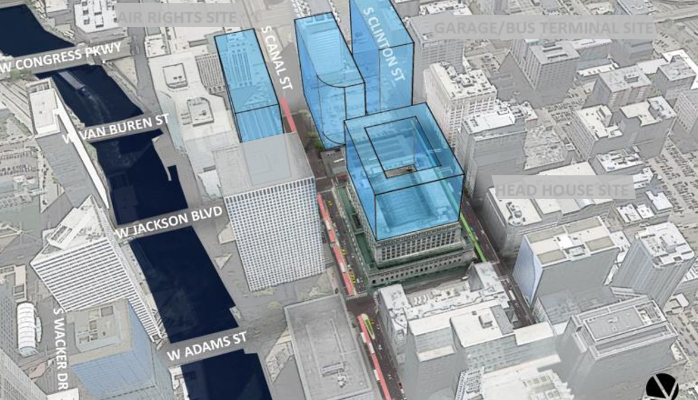

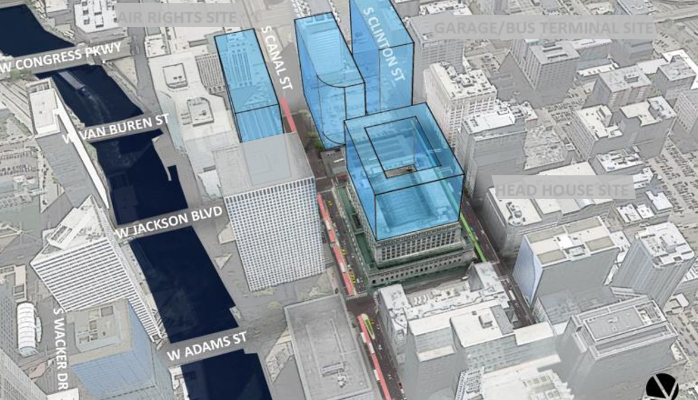

When Utah House Speaker Greg Hughes was tapped to serve on the Utah Transit Authority’s board in Salt Lake City, he confessed that he didn’t even believe at the time that transit was a prudent investment. But part of the powerful story of how he came to see the necessity of investing in transit was his discovery that certain highways being widened (at high cost) would be at capacity and completely congested within only six years.

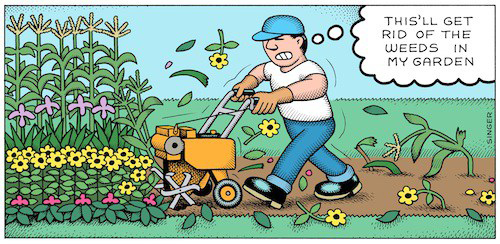

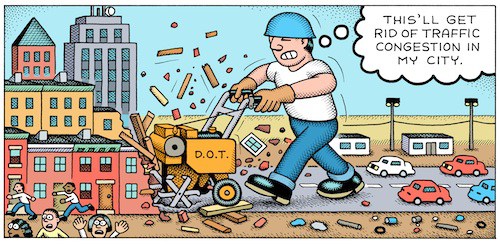

And as he became something of an evangelist for investing in transit to provide more options and a balanced, multimodal system for the booming region, he would point out the heavy cost of putting all the eggs in one basket. “How much land would we have to condemn to do something like this? How much would this cost?” he would ask other local leaders in tandem with this photo from his presentation:

But perhaps the most exciting part of Capital Ideas was the 25-plus separate breakout sessions that stretched across both afternoons.

After half a day firmly rooted in folding chairs mostly being talked to, the breakouts allowed participants to interact and go hands-on with notable experts. Experts like Dave Williams with the Metro Atlanta Chamber, who shared Georgia’s experience with passing state legislation to enable local transit referenda. (A measure that Atlanta voters approved last week to raise $2.5 billion in new tax money to invest in MARTA and transit in the region.)

Dave Williams with the Metro Atlanta Chamber, top center, walks his table through Georgia’s experience passing state legislation that altered the state’s gas tax and also enabled Atlanta to go to the ballot for transportation funding.

During the breakouts, Maryland Delegate Brooke Lierman, right, shared her experience advancing state legislation to begin evaluating and scoring transportation projects on their merits.

We covered an incredible range of topics, but a few clear themes and a hopeful undercurrent ran throughout the two days.

T4America Director James Corless noted that nearly every story of transit ballot box success was preceded by a failure. Salt Lake City. Denver. Seattle. Atlanta. And the list goes on.

“It’s OK to fail,” he exhorted everyone. “It’s ok, as long as you learn and get back up. And you have to get back up.” And most importantly, “There is no need to do it alone. And in fact, you can’t do it alone!”

Indianapolis shows a good road map for doing it together.

“Indy’s strong local coalition [for their successful transit ballot measure] included the Indy Chamber and numerous faith-based groups and churches,” he noted. “That’s a good roadmap for coming together to make the investments we need to build prosperous local economies and ensure that everyone can connect to opportunity.”

With a lot of looming question marks about federal transportation funding and policy right now, the importance of getting state (and local) transportation policy right is coming into sharp focus.

As the conference closed wrapped up Thursday afternoon, T4America chairman and former Mayor John Robert Smith offered a reminder that solutions need to come from the bottom up, and that we will succeed or fail based on the breadth of the coalitions we build.

“We’ve heard about the importance of knowing who is in the foxhole with you and appreciating the strength of those in the foxhole with you, but I want us to expand and broaden the coalition we have here. We’re going to need to be bipartisan and inclusive,” Mayor Smith urged participants. “I want you to help us find those people, find those stories, lift up those stories and support that voice and perhaps we can have an impact on minds that might otherwise be closed.”

“We’ve heard about the importance of knowing who is in the foxhole with you and appreciating the strength of those in the foxhole with you, but I want us to expand and broaden the coalition we have here. We’re going to need to be bipartisan and inclusive,” Mayor Smith urged participants. “I want you to help us find those people, find those stories, lift up those stories and support that voice and perhaps we can have an impact on minds that might otherwise be closed.”

And for those discouraged by what’s happening at the federal level (or any level, truthfully) when it comes to decisions made about investing in transportation, Mayor Smith reminded everyone — especially the scores of elected leaders in the room — to hold fast to the long view of progress.

“When I speak to local elected officials, I always tell them: If your commitment and vision is limited by a four- or eight-year term, you’re failing the people you represent,” he said.

“Your commitment and vision has to be decades ahead. It has to be beyond your service, and perhaps even beyond your lifespan. The work that we do, the plans we make, the vision we have, will neither be completed and realized nor will it be destroyed in a four- or eight-year term. Our vision, our plans, our commitment are bigger than that. They’re bolder than that. They’re more resilient than that. I want to encourage you: stay that course, be that voice.”

We’re incredibly grateful for the 200-plus people who traveled to Sacramento for Capital Ideas and helped made it a rousing success. Thank you so much for joining us. Many of the participants who came to learn were also some of the policy experts at the roundtables. Panelists stuck around and dove into other issues they were interested in. Capital Ideas was knowledge- and experience-sharing of the highest order.

Our heartfelt thanks goes to the Sacramento Area Council of Governments for co-hosting the conference and pitching in at every turn and in every way. And we thank our sponsors: TransitCenter, Uber, CalTrans, the Metropolitan Transportation Commission and the Rails-To-Trails Conservancy.

See you in 2018??

By authorizing TFIA, the Illinois General Assembly created a way for Chicago to provide the necessary match for Red/Purple Line modernization and critical improvements to

By authorizing TFIA, the Illinois General Assembly created a way for Chicago to provide the necessary match for Red/Purple Line modernization and critical improvements to