Earlier this spring Utah became the third state in 2015 to pass a comprehensive transportation funding bill, raising the state’s gas tax and tying it to inflation. Unlike most other states acting this year, Utah raised revenues to invest in a variety of modes and also provided individual counties with the ability to go to the ballot to seek a voter-approved sales tax to fund additional local transportation priorities.

Fueled by the highest birthrate in the country, Utah’s population is expected to double by 2060. The state’s existing transportation funding sources — unchanged since 1997 and losing value against inflation — would not be sufficient to meet the demands posed by the rapidly growing population. Working proactively, the Utah Legislature and stakeholders worked together to raise new funding for transportation and ensure that the state stays ahead of the population boom.

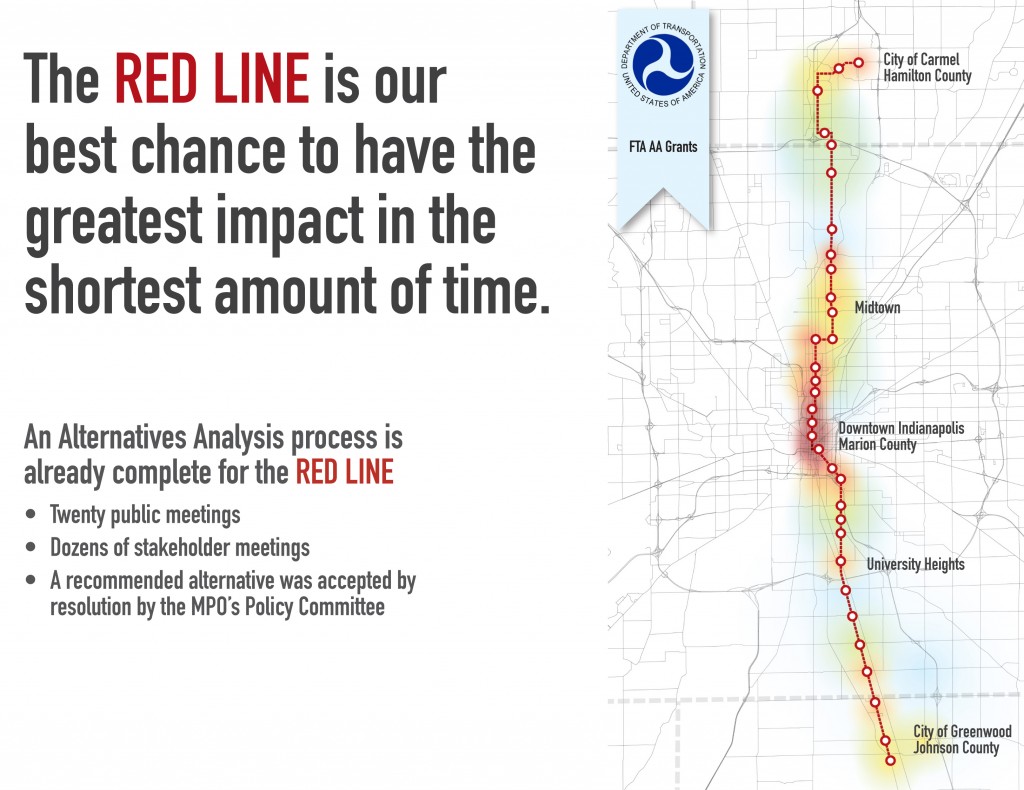

TRAX Red Line to Daybreak at Fort Douglas Station. Flick photo by vxla. https://www.flickr.com/photos/vxla/

What does the new funding package do?

The new law, passed in March 2015, will generate approximately $74 million annually by replacing the cents-per-gallon gas tax with a new percentage tax indexed to future inflation. The bill also enables counties to raise local option sales taxes, which, if adopted by every county, would generate $124 million in new annual revenue specifically for local needs.

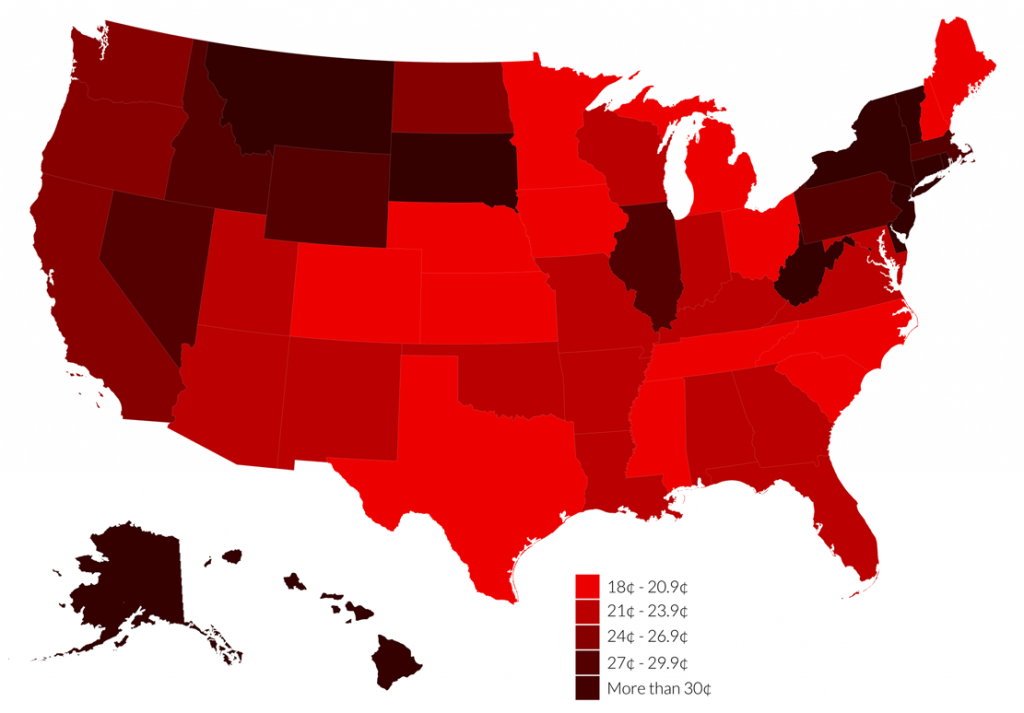

In specific terms, the bill replaces Utah’s current fixed 24.5 cents-per-gallon rate with a new rate of 12 percent of the statewide wholesale gasoline price, beginning January 1st, 2016, and indexes that rate to inflation. The bill also specifies that the tax can’t dip below the equivalent of 29.4 cents per gallon (i.e. a floor mechanism) or climb above 40 cents per gallon (i.e. a cap mechanism). Additionally, diesel, natural gas and hydrogen will see an incremental rise in their taxes until they reach 16.5 cents per gallon (an eight-cent increase for diesel and natural gas).

Importantly, the bill also enables all Utah counties to ask voters to approve a 0.25 percent local sales tax, the proceeds from which can be used to fund almost any locally-identified transportation need, whether roads, transit, bicycle and pedestrian infrastructure or other related projects. Revenues from these county sales taxes would be split between the county (20 percent), cities (40 percent), and a county’s transit agency (40 percent). If a transit service area doesn’t exist in the county, the money is split between the county (60 percent) and cities (40 percent).

Due to a constitutional restriction, all state gas tax revenue generated in Utah may only be used on roads, so this new optional sales tax gives counties and local governments a new mechanism to raise funds for their pressing needs, whatever they may be. While the state will see a much-needed revenue increase that can be invested in the state’s Unified Transportation Plan, the local option sales tax is a very important provision that could give localities of all sizes extremely flexible resources to meet their pressing local needs.

Lynn Pace, Vice President of Utah League of Cities and Towns

“There was a major push to say that we need a more multimodal transportation system,” said Lynn Pace, vice president of the Utah League of Cities and Towns. “We needed more flexibility, and that pushed people towards the [local option] sales tax because it was flexible, more flexible than the gas tax.”

Political compromises on the way to passage

At the end of 2014’s legislative session, a transportation bill that, much like this year’s bill, would have allowed counties to impose a voter-approved quarter-cent sales tax to fund transportation was defeated. There were other funding bills that died, including one that would have increased the gas tax by 7.5 cents per gallon and another that would have reduced the gas tax from 24.5 to 14 cents per gallon while adding a 3.69 percent fuel tax. In the end, there wasn’t adequate consensus between legislators to get a bill done in 2014.

This year was different, however.

The 2015 session started with an effort to raise or otherwise reform Utah’s gas tax. The Speaker of the House, Rep. Greg Hughes (R-Draper), wanted to drop the per-gallon flat tax and change it to a percentage tax so that the tax rose and fell with gas prices. Senate President Wayne Niederhauser (R-Sandy), however, felt that tying the gas tax to fluctuating gas prices was too risky. Prices could rise and fall dramatically, he said, subjecting Utah drivers to suddenly higher gas prices (or declining revenues coming to the state with low prices). To eliminate the uncertainty, Niederhauser wanted a straight increase in the gas tax.

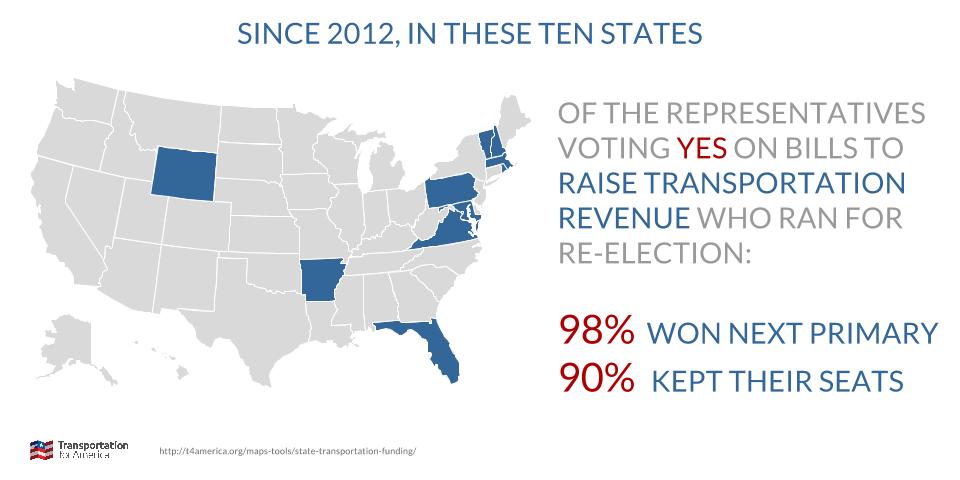

Hughes however, didn’t believe that representatives in the House would pass a tax increase, fearing political fallout. Pegging the tax rate to gas prices would allow the state to eventually see revenues increase as gas prices rise without the political risk of imposing taxes immediately. In the end, the bill indexes the gas tax rate to inflation, but with a floor and ceiling put in place to counter destabilizing fluctuations in the gas price.

Hughes however, didn’t believe that representatives in the House would pass a tax increase, fearing political fallout. Pegging the tax rate to gas prices would allow the state to eventually see revenues increase as gas prices rise without the political risk of imposing taxes immediately. In the end, the bill indexes the gas tax rate to inflation, but with a floor and ceiling put in place to counter destabilizing fluctuations in the gas price.

The importance of including the local option sales tax

Legislators had a similar back-and-forth on the bill’s other major revenue-raising provision: the local option sales tax.

Rep. Johnny Anderson (R-Taylorsville), the sponsor of this provision, wanted to ensure that money from the sales tax went to transit before it went to roads. Rep. Jim Dunnigan (R-Taylorsville), however, wanted to put that decision in the hands of the voters and local elected officials.

As legislators moved towards the end of the session, the House and Senate passed different versions of the transportation bill. The Senate opposed allowing counties to impose a voter-approved sales tax, but the House insisted. Eventually, the chambers came to an agreement, provided that local option sales tax revenues could go to not just transit but all forms of transportation, from roads to transit, bike and pedestrian infrastructure.

Staying on message

The 2014 debate on transportation funding by Utah legislators laid some of the important groundwork for this year’s success. But this time, several ingredients (and some notable changes) came together this year to help convince formerly skeptical legislators to vote yes.

The bill’s supporters — which included the Wasatch Front Regional Council, the Utah League of Cities and Towns, and the Utah Transportation Coalition, among others — were able to present a compelling and winning message about why Utah needed to raise additional dollars to invest in the transportation system. They talked about the critical economic development connection, as well as accommodating and moving more people and goods within the booming state over the next 25 years. Supporters educated both the public and legislators about why Utah’s communities need to be able to raise funds for and invest in multimodal transportation projects.

In a conservative state like Utah, supporters found that economic arguments worked best for convincing legislators and the public that transportation is a worthwhile investment. Their argument was two-pronged: first, a state with a good transportation network can more easily attract businesses, which need solid transportation infrastructure to attract talent, get their employees to work, and ship their goods, and, second, that waiting to repair critical transportation infrastructure will make maintenance cost more in the long run.

Read T4America’s separate 2014 profile of Utah’s “Can-Do” transportation ambitions.

With stories of partisan gridlock making headlines every day, Utah stands out as a model of collaborative planning for a better future. State leaders and citizens have managed to stare down a recession while making transportation investments that accommodate projected population growth and bolster the economy and quality of life.

With stories of partisan gridlock making headlines every day, Utah stands out as a model of collaborative planning for a better future. State leaders and citizens have managed to stare down a recession while making transportation investments that accommodate projected population growth and bolster the economy and quality of life.

Click through to read the full story.

To make sure that the message really resonated, supporters made sure that they were all singing from the same sheet.

The Utah Transportation Coalition — a group that includes the Salt Lake Chamber of Commerce and the Utah League of Cities and Towns — conducted two years of studies to find the facts they needed for their education campaign.

“What we did differently this year versus last year — in years past — is that we worked together, we were all in lockstep together, we knew our message, stayed on message,” said Abby Albrecht, Director of the Utah Transportation Coalition. “We worked really hard to be the voice in the community and in the legislature about transportation, why it was so important for our economy, for our quality of life, to our healthcare.”

A clear, unified plan for future investment

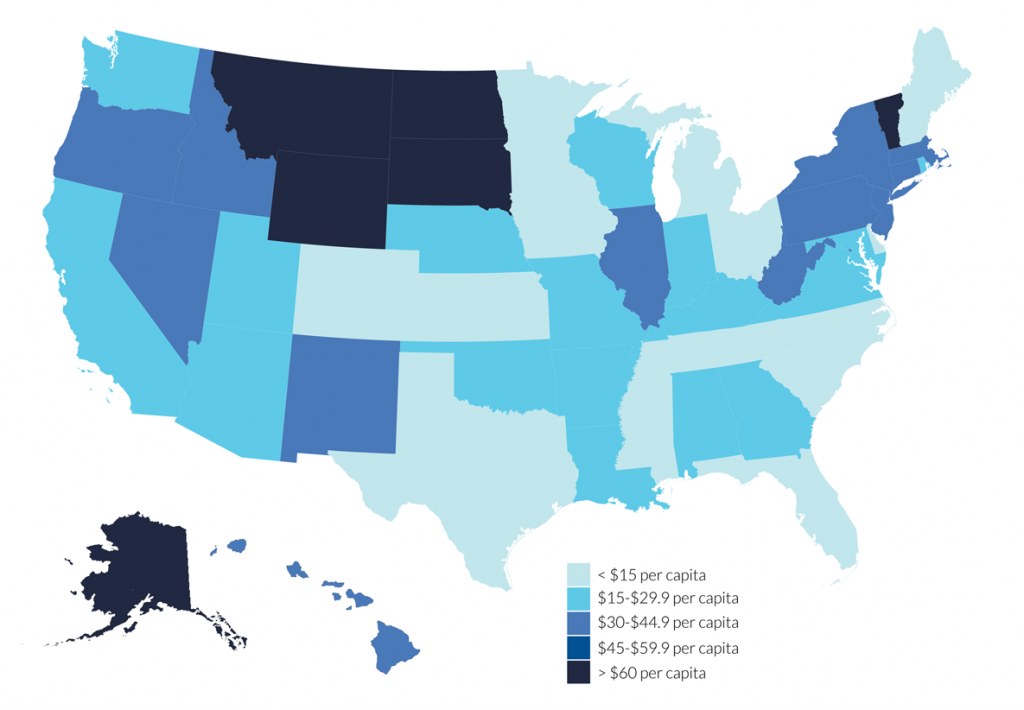

That singular message is captured in Utah’s Unified Transportation Plan, a statewide transportation plan synthesized from several regional plans and plans from the state DOT and the Utah Transit Authority. The unified statewide plan prioritizes those needs and outlines the $11.3 billion most critical projects to fund.

Having a statewide plan in which everyone could see their needs reflected helped everyone feel that the entire state was working together to develop a holistic vision for the future instead of a bunch of regions competing against each other for the same funds. That unity of purpose across the state helped bring legislators on board.

“Every legislator has skin in the game at that point,” saidMichael (Merrill) Parker, Director of Public Policy at the Salt Lake Chamber of Commerce. “It’s not urban versus rural, or region versus region; every legislator is in the same camp trying to solve one problem, not their local district’s problem.”

With a clear vision in hand, supporters worked hard to spread that message.

“There was a [unified] plan in place, an agreed-upon plan in place, saying, ‘This is what needs to be done, we all agreed that this is the plan, and here are the gaps in funding,’” said Pace, from the Utah League of Cities and Towns. “So, it put us in the position to say, ‘We all agreed what needs to be done. Utah’s population is going to double in the next 30 years, we need funding to implement the plan, to help make it happen.’”

All of that education paid off.

The law passed the House on March 9th and in the Senate on March 12th. Governor Gary Herbert signed the law on March 27th. This provides counties the ability to place local sales tax referendums on the ballot as early as November 2015.

On to the ballot box

Supporters cheered the bill’s passage in March, but there are still important hurdles to clear to reach the bill’s full potential. The bill could raise an additional $124 million annually for transportation if adopted by all Utah counties. Groups like the Salt Lake Chamber and Utah Transportation Coalition are embarking on public education campaigns in the counties that are placing local sales tax questions on their November ballots.

110 of Utah’s 244 cities have passed resolutions urging their county governments to put the proposition on November ballots, and as of August 24th, 12 of Utah’s 29 counties have taken action to do exactly that. That list of 12 counties includes Salt Lake County, the state’s most populous county, and where, according to the Salt Lake Tribune, elected officials in all 16 cities supported the county’s action in August 2015 to place the initiative on this November’s ballot.

Salt Lake County Mayor Ben McAdams

The mayor of that county, Salt Lake County Mayor Ben McAdams, knows how important investing in Utah’s transportation is, especially since his region is the most populated in the state:

“We want to have a visionary approach to transport, where we look into the future and forecast what our region is going to look like. We know that a transit-oriented future will improve quality of life, save tax dollars, and really help us develop the kind of community we want to live in. That all takes forethought and planning.”

This year’s move by the legislature was a triumph of bipartisan cooperation and compromise, undergirded by the clear vision for investment that local leaders and civic groups have bought into. As a result of their successful work, the state will see an increase in transportation funding in 2015, but we’ll be watching especially closely this November as Utah counties join countless others in deciding measures at the ballot to also raise new local money for transportation.

Need a quick summary of Utah’s transportation law? You can read it here.

Want more information on states moving to raise new transportation revenues at the state or local level? Don’t miss our page of resources chronicling the active and enacted plans since 2012.

There’s both a lot of uncertainty and disruption in America’s transportation landscape right now, from pothole-riddled roads and no money to repair them (an age-old issue) to brand new tech-enabled transportation options (electric scooters anyone?). Stuck between shifting national politics on one hand, and cities scrambling to keep up with dramatic changes to urban transportation on the other, are the states. How is the state’s role evolving when it comes to transportation?

There’s both a lot of uncertainty and disruption in America’s transportation landscape right now, from pothole-riddled roads and no money to repair them (an age-old issue) to brand new tech-enabled transportation options (electric scooters anyone?). Stuck between shifting national politics on one hand, and cities scrambling to keep up with dramatic changes to urban transportation on the other, are the states. How is the state’s role evolving when it comes to transportation?![]()