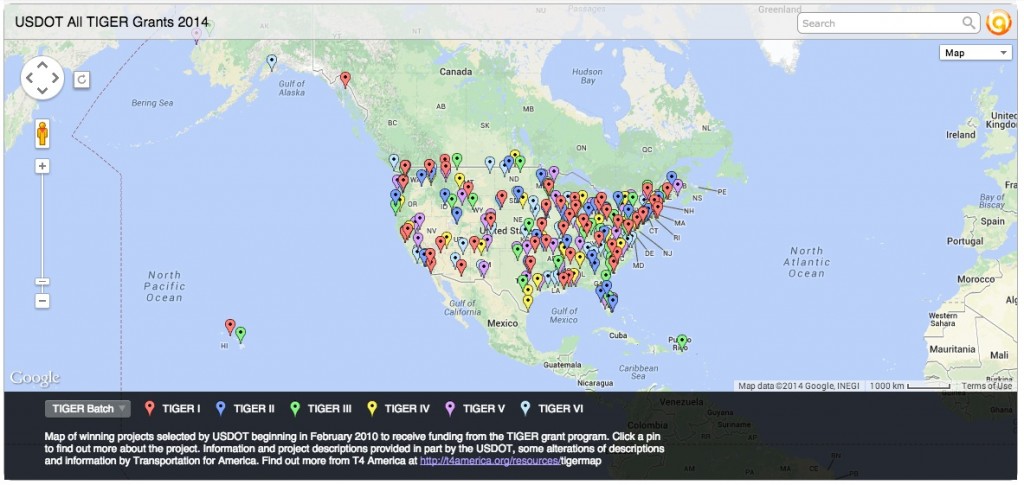

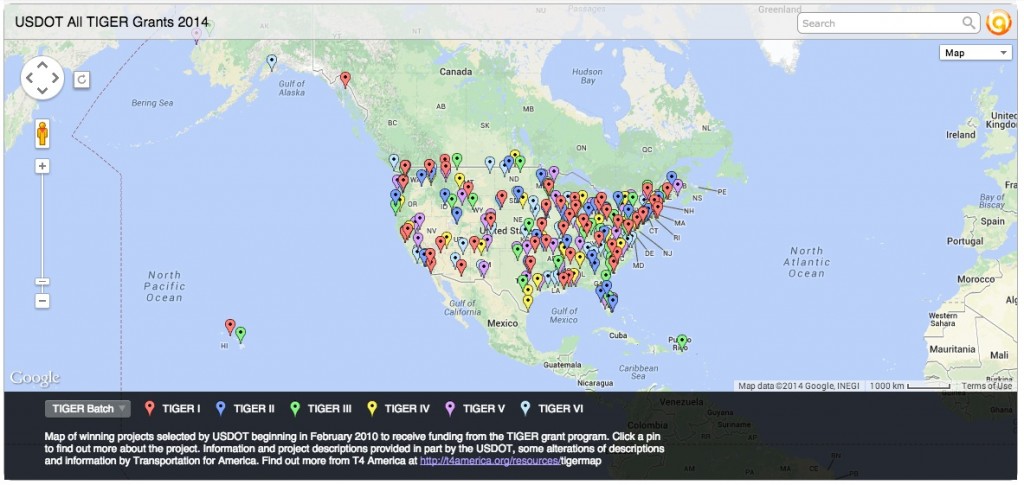

The latest (sixth, if you’re counting) round of TIGER grants has been released — $584 million worth going to 72 projects in every corner of the country. (Click on the map below to see them on our updated interactive map.)

TIGER grants, you’ll recall, can go to any mode or combination thereof, and often go directly to local governments or transportation agencies – unlike most other federal dollars, which are targeted to specific modes and flow through the state department of transportation via funding formula. Given their flexibility and ability to support innovative proposals, TIGER dollars are intensely sought-after.

This year was no exception. The U.S. DOT says it received “797 eligible applications from 49 states … an increase from the 585 applications received in 2013. Overall, applicants requested 15 times the $600 million available for the program, or $9 billion for needed transportation projects.”

One of the best features of TIGER is that it brings all kinds of other money to the table – local, state and even private. Each one of those TIGER dollars will leverage almost three dollars in matching funds from other sources. (*The matching funds can include other federal money in some cases).

The U.S. DOT identifies each project by primary mode. By that reckoning, 15 of the 72 (27 percent) were for primarily transit projects, while 26 were road projects, or 38 percent. But, of course, many of them address more than one mode – which makes them TIGER projects!

“The U.S. DOT has done an outstanding job of selecting a wide variety of innovative projects in communities small and large,” said James Corless, director of Transportation for America. “Because they arise out of local initiatives to meet local needs, these TIGER projects will save lives, improve commutes and access to jobs, reduce costs for goods shipment and add to the quality of life wherever they are completed.

“Once again, TIGER has illustrated the incredible demand for flexible dollars to help local communities do the projects that support the modern economy and solve multiple problems at once. Congress needs to build on this success by creating a larger pool of dedicated funding for competitive grants both at the national level and within each state.”

Here some highlights of the kinds of projects funded:

Connecting workers at all wage-levels to jobs. In Richmond, VA, a $24.9 million grant will go towards a 7.6 mile bus rapid transit line to “connect transit-dependent residents to jobs and retail centers as well as spur mixed use and transit-oriented development in a city with the highest poverty rate in Virginia,” according to the DOT summary. Omaha, NE, will receive $15 million for a new bus rapid transit spine to reduce travel time to major employment hubs in the city. “Roughly 16 percent of the households within a quarter of a mile of the proposed bus-rapid transit route do not currently have access to a vehicle.” Pittsburgh, PA, received $1.5 million toward design of a “cap” over Interstate I-579 that would connect lower income residents of to downtown jobs.

Making optimal use of road capacity. The Champaign-Urbana region and the University of Illinois won $15.7 million toward a $35 million project “to construct Complete Street corridors connecting the Cities of Champaign and Urbana to the University of Illinois and improve transit travel between the cities and the campus.” In Maryland, $10 million is going toward a $42 million “road-widening project that would upgrade MD 175 from an existing two-lane undivided arterial to a six-lane divided arterial, complete with a trail, sidewalks, and on-road bicycle facilities.”

Freight and ports. TIGER is one of very few avenues for support for freight in the entire federal surface transportation program. (We’ll be exploring that deficiency in this space soon. –Ed.) This round, $11 million goes to the South Carolina State Ports Authority to rehabilitate and improve connections and access, and $20 million to the Port of Seattle Terminal 46 project to rehabilitate port facilities; “construct a storm water system to treat terminal runoff; increase load capacity and extend crane rail at dock; construct new road to grade-separate truck traffic from rail yard; and provide public amenities to access 13.8 acres of habitat around the terminal site.”

Safety for people on foot and bicycle. Among the largest awards, the City of New York’s Vision Zero safety effort won $25 million toward a $50 million, 3-part safety improvement program across the five boroughs including “safe pedestrian access to schools, safe pedestrian access to transit, and safe bicycle access to jobs via completion of a trail system connecting economically distressed communities to employment centers,” according to U.S. DOT.

Smart planning. $210,000 goes to North Central Texas Council of Governments for Land Use Transportation Connections to Sustainable Schools Project, creating a regional program and implementation plan to promote connections and coordination between transportation agencies, local governments, and schools within North Central Texas. In St. Paul, MN, $200,000 will fund a design study and master plan for reusing the Canadian Pacific Rail Spur as a multimodal corridor for bicycles, pedestrians, and possibly transit. The overall objective will be to develop a plan for how the bicycle, pedestrian and transit communities can use the rail line.

TIGER grants have now been around long enough that we’ve seen winning projects go from start to finish, like the Uptown Station project in Normal, Illinois — just one that shows how the targeted transportation investments in TIGER can help create jobs, boost local economic development efforts, connect people to jobs, improve freight movement and revitalize communities across the country.