In many states local jurisdictions have to get permission from their state legislature to raise local funds for transportation. One of the most notable examples of this will be taking place in a county in the heart of metro Atlanta, Georgia.

Click for more stories and information about a few key issues that will be decided on November 4

From the day when Clayton County, one of metro Atlanta’s core five counties, had to cancel their bus transit service outright in 2010, local leaders have been trying to figure out how to bring back transit service back and better connect their residents with jobs and opportunities.

In a county with a large population of low-wage workers, residents and employers alike are hungry for an affordable and reliable way to get around and get to work. C-Tran, the former county-run bus service, provided more than 2 million rides each year, helping residents get to jobs — especially the thousands of jobs in or near bustling Hartsfield-Jackson International Airport in the north end of the county.

Read a short story of how shutting down the system affected one Clayton resident. From the Atlanta Journal-Constitution.

This story came from the Atlanta Journal-Constitution as C-Tran was shutting down:

Twenty-year-old Bridget Milam takes Clayton County’s bus system, C-Tran, wherever she goes. She takes it to Brown Mackie College in Atlanta, where she’s getting an associate’s degree in early childhood education. She rides it to her job at a day care center. She has never had a car and can’t afford one now. C-Tran is her lifesaver. Not for long.

…[she] may have to put school and her day care job on hold. “It means I have to find a job closer to home, in walking distance,” she said. “It would probably be fast food.” …Milam expressed frustration that she will “have to settle rather than doing something that could further my career.”

Click to open

It was a huge blow to the residents of Clayton County when county commissioners shut the service down in 2010 in the face of a recession-fueled budget crisis. Federal start-up funds and support from the Georgia Regional Transportation Authority had kept the service going since the early 2000s, but with that funding drying up the county faced a deficit that was too much to overcome.

Clayton County voters will decide a one-percent sales tax on Nov. 4 that will bring them into the MARTA system and bring bus service into the county. Flickr photo by James Williamor.

On Nov. 4, Clayton County voters will decide on a measure to increase the local sales tax by a percent to join MARTA, the regional transit system. Doing so would restore bus service and jumpstart planning for bus rapid transit or a rail extension in the years to come. As county commissioners debated whether or not to put the question on the ballot, they heard hefty support from residents, who turned out to meetings to urge commissioners to make a vote happen. And most of the commissioners saw the need. From a piece by Next City, published just yesterday:

At a packed board of commissioners meeting on July 1st, former State Rep. Roberta Abdul Salaam described what this looked like for formerly bus-dependent residents.

“I have people, students, young men that can’t take jobs for the summer because we don’t have transportation for them,” she said. “And someone said earlier don’t make it emotional — well let me just apologize now. I get emotional when I see little old women walking down Tara Boulevard in the ditch in the rain, and there’s not even anywhere to pull over and pick her up.”

Yet voters in Clayton County, or anywhere else, can only have this opportunity if the state they live in has authorized local communities to raise revenues through ballot measures.

“Enabling” legislation

State enabling laws must be in place before local ballot measures can even be considered — they either have to be on the books already, or passed ahead of a specific measure (as happened in Clayton’s case). These laws can govern many aspects of local ballot measures, including the type and duration of the levy, the process for getting a measure on the ballot, the permissible uses for the revenue, and sometimes even the exact language that must be presented to the voters.

A handful of bills were passed recently enabling local governments to raise local revenues for transportation in MN, PA, IN, NV, and CA and bills were considered in AL, MD, MI, SC, SD, UT, VA and WA during the 2013-2014 sessions. We recently covered a notable example in Indiana, where a law was passed just this year allowing Indianapolis to finally raise local funding to invest in their ambitious regional IndyConnect plan.

To make this vote possible for Clayton County, the Georgia General Assembly had to pass a pair of laws to “enable” Clayton to take the measure to the ballot, and they did so in 2013, with some specific restrictions.

Interestingly, state law already provided for Clayton to be a part of MARTA, and as one of the five core counties included in the 1970’s charter actually had a vote on the MARTA board. But Clayton and two other counties declined to pass the sales tax, and only the City of Atlanta, Dekalb and Fulton counties ponied up. In the meantime, Clayton had used it’s available sales tax percentage — state law caps it — for other purposes. That meant that the state had to waive that cap specifically for Clayton so they could decide on the MARTA tax. (A second piece of legislation was required to restructure the MARTA board to give Clayton County two representatives on the board starting next year.)

The legislation specified that the vote be restricted to raising revenue to join MARTA, rather than contracting for service as in the past, and the county had to take action this year.

Read this short primer on enabling legislation from our “Measuring Up” package of resources geared around state transportation funding.

All state enabling laws are not created equal. A great counter-example is the one provided by the same Georgia assembly just a few years earlier. After no fewer than three tries before the state legislature, the state finally gave all Georgia metropolitan regions the power to pass regional transportation sales taxes. But that also came with a mandated two-year political process to develop a project list that swelled to 157 highway and transit projects for Atlanta in the end.

That 2012 referendum to raise $7.2 billion to invest in regional transportation needs failed in metro Atlanta for a lot of reasons, but as we opined at the time, the way the enabling law was written by the legislature may have contributed to its demise.

“Many voters also complained of a sense that the project list was a goodie bag for various political interests and not a cohesive plan to address well-articulated needs. The Legislature-mandated process almost assured that outcome. It called for creating a 21-member “regional roundtable” made up of a mayor and county commissioner from each of the region’s ten counties, plus the mayor of Atlanta. While the “pro” campaign pitched the project list as a solution to congestion, the list struck many voters as a collection of pet local projects that did not necessarily add up to a thought-through plan.”

In the end, there was a lot of “include my project on the list and we’ll support yours” horse-trading amongst the representatives developing the project list that might have doomed the measure.

Clayton’s prospects on November 4

But Clayton voters face a simple question on November 4: raise local sales taxes by a percent to join MARTA, create new robust bus service into the county starting in March 2015, and save half of the revenues (locked away in escrow) for planning or building some higher capacity transit in the years to come. And one thing we know from experience with ballot measures is that the simpler the question and the more clear it is what the money is going to buy, the more likely voters are to support it.

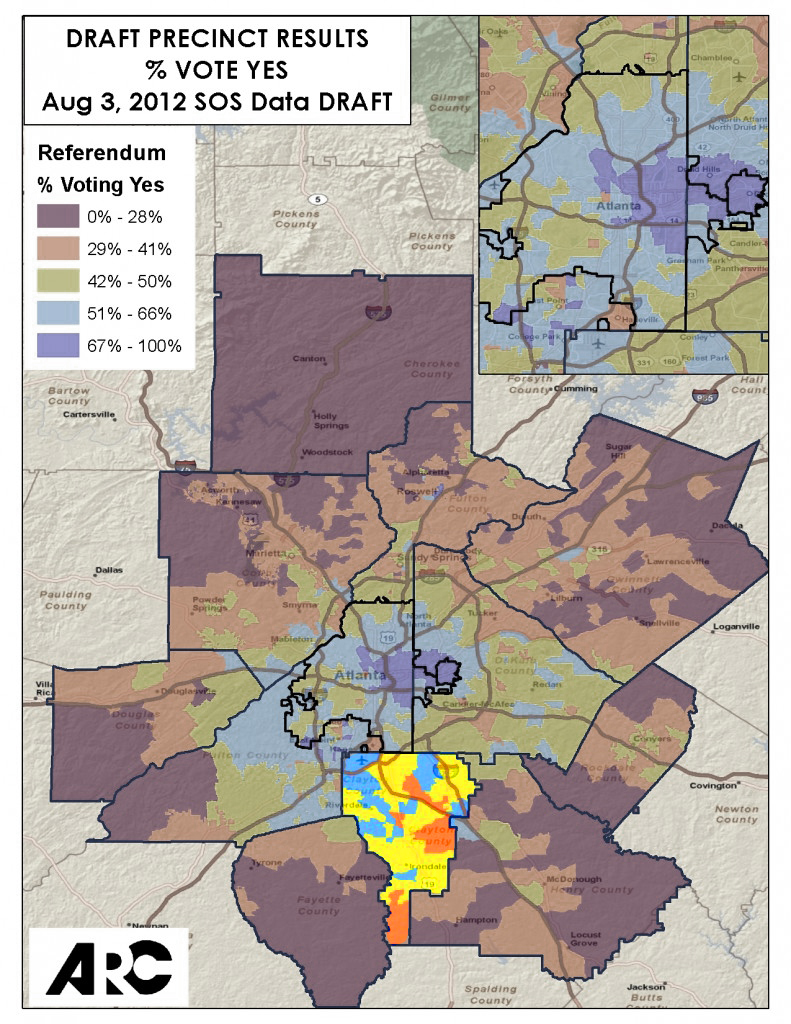

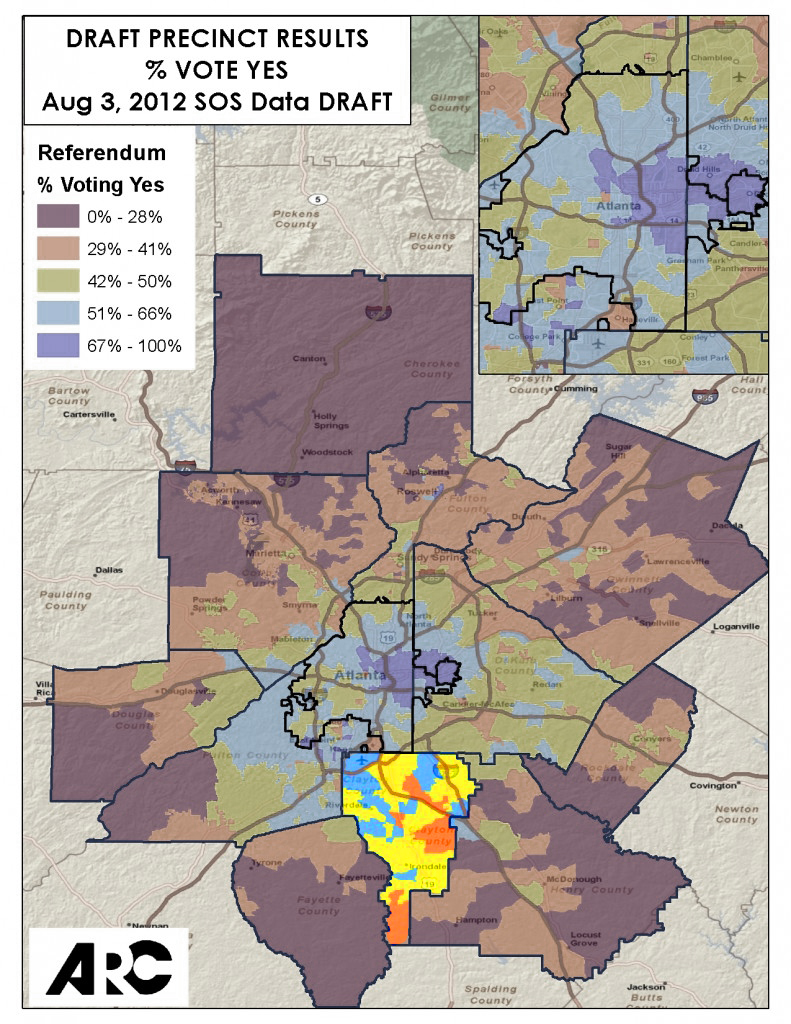

It’s also worth looking back at how Clayton County voted on that aforementioned regional transportation tax from 2012 — one that did include restored local bus service for Clayton, but which wasn’t expected to begin service for at least two to four years after the vote. It also included a handful of road improvement projects and initial development of a long-awaited commuter rail line south toward Macon that would run through the county.

If you look at that graphic, where Clayton is highlighted near the bottom, the bulk of the county’s precincts supported it between a 42-66% clip, with a handful of precincts at numbers below that. On top of that, more than 7o percent of voters approved the concept of participation in a regional transit system in a nonbinding referendum on the ballot just a couple of years ago.

The local experts we talked to were all cautiously optimistic that it’s going to pass, and many local political analysts are suggesting that it could possibly win by a pretty significant margin. Of course, turnout will play a big role in what happens, as always. We’ll be watching closely on election night and reporting back here, so stay tuned.

Want to know more about enabling legislation? Need help doing what Clayton County had to do and getting your state to clear the way for a local revenue-raising measure? Join us in Denver in just a few weeks on Nov. 13-14 for Capital Ideas — the premier conference for state legislation related to new transportation revenue.

Though more than

Though more than