Supported by 23 cosponsors in the House, the Chairman of Transportation for America and a plethora of national construction, transportation and labor groups, Rep. Earl Blumenauer (D-OR) alongside Rep. Peter Welch (D-VT) introduced the UPDATE Act to increase the federal gas tax by 15 cents over three years and index it to the inflation.

T4America chair Mayor John Robert Smith speaking at a press conference announcing the UPDATE Act on Wednesday, February 4, 2015.

Speaking at a press conference this afternoon following the bill’s (HR 680) introduction earlier this week, Rep. Blumenauer referred to the complicated plans to raise one-time revenue for transportation through corporate tax reform or repatriation of overseas profits and noted that raising the gas tax is “the simplest, easiest to pass, and the only one giving long term stability.”

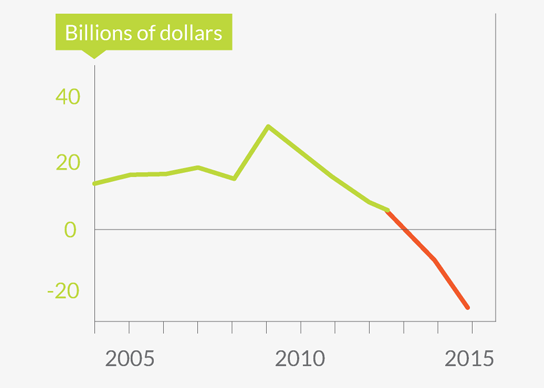

His plan is certainly the simplest to understand: an increase of five cents in the federal tax on gasoline and diesel for three consecutive years, and then setting it to rise or fall with inflation. Even without more fuel efficient vehicles or Americans driving less overall, inflation has eroded more than a third of the gas tax’s buying power over the past two decades. This plan puts the onus to pay for improved transportation systems on those that use them each day, reinforcing the principle of the users paying for the system.

While all of the 23 cosponsors so far are Democrats and many House GOP leaders have ruled out a gas tax increase, plans like this (or other similar plans to raise revenue) don’t have to be a political third rail. T4America co-chair Mayor John Robert Smith spoke directly to that point at the press conference today:

“When you analyze the election results from the 10 states that raised revenue for transportation since 2012, 98% of those legislators who voted in favor of raising revenue for transportation were re-elected in their next primary. That’s worth repeating, 98% of legislators who stood up and led to raise revenue for transportation were re-elected by their constituents. That is a message members of Congress need to hear and their constituents cannot wait much longer for them to act.”

We do indeed need greater revenue to stabilize the nation’s nearly-insolvent transportation fund, but we also need better policies and reforms to ensure those limited dollars are spent on the projects that provide the highest return. Measuring the performance of our limited transportation dollars to better understand what our dollars get us each year would be a smart place to start. And a forward-looking plan to direct more of that money down to where it’s needed most would be a great companion to any plan to shore up the nation’s transportation funding.

Mayor Smith, as the former mayor of Meridian, MS, understands those challenges facing local communities well, and still hears about them regularly from his former colleagues.

“I’ve been in local elected office for 20 years and early on I realized people back home would be forgiving and will back their incumbent when they see them stand up and lead on issues essential to their wellbeing,” Mayor Smith said at the event. “In Meridian transportation is one of those issues. And transportation is certainly an essential issue for this nation’s wellbeing,”

“Every credible independent report indicates that we are not meeting the demands of our stressed and decaying infrastructure system – roads, bridges and transit,” said Rep. Blumenauer in his press release.

“Congress hasn’t dealt seriously with the funding issue for over 20 years and it’s time to act. The gas tax used to be an efficient road user fee, but with inflation and increased fuel efficiency, especially for some types of vehicles, there is no longer a good relationship between what road users pay and how much they benefit. The average motorist is paying about half as much per mile as they did in 1993. There’s a broad and persuasive coalition that stands ready to support Congress…we just need to give them something to support.”

We support Rep. Blumenauer’s efforts because it provides a long-term, efficient, and sustainable funding source that our local government and businesses can plan for and rely on. With the May 31 deadline of the existing transportation looming on the horizon and states like Tennessee and Arkansas already delaying projects or considering doing so in light of the uncertainty, it’s important that Congress act sooner rather than later.