Catch up with yesterday’s launch webinar for T4America’s new guidebook, Fight for Your Ride: An advocate’s guide for expanding and improving transit, which offers tangible ways to improve transit in your city and region.

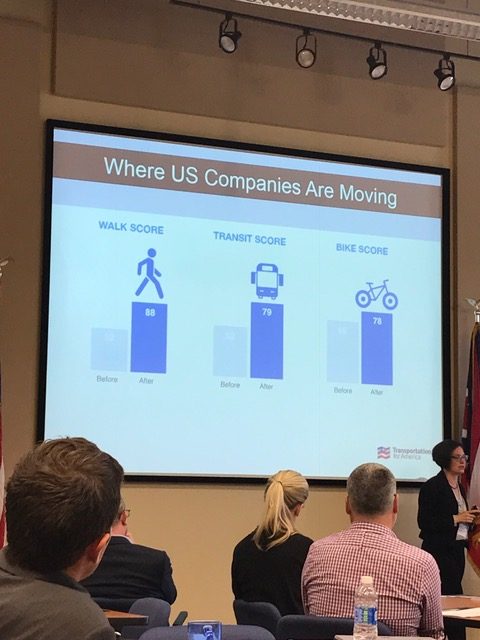

Quality transit service is increasingly becoming a “must-have” for economic development. Amazon’s HQ2 search is only the most public example of major businesses choosing locations with quality transit to expand. Quality transit is also vital to improving access to jobs and opportunity and creating pathways to prosperity for residents in your region. But how can business leaders, local elected leaders, or transportation advocates improve their local transit service?

T4America’s new guidebook, Fight for Your Ride: An advocate’s guide for expanding and improving transit, offers tangible ways you can make these needed improvements to transit in your city and region.

On a webinar to release the guide earlier this week, two local transit leaders—Karen Rindge, Executive Director of WakeUp Wake County in the Raleigh, NC area, and Christof Spieler, board member for Houston METRO—presented lessons from their successful transit initiatives. View the full webinar here:

Fight for Your Ride includes tactical guidance on how to build your coalition, how to hone your message, and how to advocate to your federal representatives. On the launch webinar, Karen Rindge shared her firsthand lessons from organizing a coalition and successful campaign in Wake County.

Rindge explained that the most important asset that helped power Wake County’s transit referendum campaign was a broad and diverse coalition. WakeUp didn’t wait until a referendum was on the ballot to build this coalition, but began nearly ten years ago engaging key partners in the effort to develop a regional transit plan and build up community support for new investments in transit. Having partners who could talk directly to different constituencies—like seniors, environmentalists, and African-American communities—allowed the campaign to cut through the crowded campaign news cycle and directly inform key voters about the referendum.

Fight for Your Ride also helps to diagnose transportation challenges in your region and offers examples of how other regions have made improvements to transit. The guide illustrates more than a dozen different approaches. Some, like building new transit lines, carry a large price tag and will take years to complete. But many of the solutions offered in the guide are smaller and can be implemented much more quickly. These include adding late night transit service, speeding buses through congested chokepoints, reducing fares for low-income youth riders, adding shuttle service to reach job sites, and realigning transit service.

On the webinar, Christof Spieler offered an example of this last tactic, presenting the story of how Houston Metro reimagined their bus system map to provide better service for riders without more funding.

Speiler explained that for METRO to change its service map, it first had to acknowledge that it was not providing useful service to all potential riders across the region.

It wasn’t that Houstonians wouldn’t ride the bus—data showed that on commuter corridors with quality bus service, more that a third of commuters were already choosing transit. But many dense corridors outside of downtown lacked frequent service, or were served by meandering routes that were too confusing for anyone except daily riders to understand. Spieler described the effort he and METRO’s leadership led to reroute all of Houston’s bus routes, all at once, to offer quality, frequent service across the city. He spoke about the obstacles they faced and how political support was critical for moving the new plan forward.

As he closed, Christof reminded us that improving transit is about more than just the right techniques or strategies — we have to be storytellers too.

“We need to talk about transit,” he said. “The more we tell the story of what transit does well, the more we tell the story of how to make transit effective, and the more we keep this on the front of people’s minds, the more success we’ll have in getting things done.”

We hope you will use Fight for Your Ride to plan efforts to improve transit in your community. We can help by leading workshops or leadership academies in your region to bring together diverse leaders and organize a transit improvement or turnaround plan.

This Ohio-only edition in

This Ohio-only edition in