Twenty-one local leaders representing three regions with ambitious plans to invest in public transportation will be reuniting in Indianapolis this week to continue the first yearlong Transportation Innovation Academy, sponsored by T4America and TransitCenter.

(This is a slightly updated version of the post we published in conjunction with the first workshop in Raleigh in early March that kicked off the Academy. – Ed.)

Similarly sized regions of 1 million-plus, Indianapolis, Nashville, and Raleigh all have notable plans to expand their transportation systems with additional bus rapid transit or rail service. In partnership with TransitCenter, T4America has created a new yearlong academy for a select group of key leaders from each region that was selected to participate. The academy is intended to share knowledge and best practices, visit cities that have inspiring success stories, and help develop and catalyze the local leadership necessary to turn these ambitious visions into reality.

All 21 participants (seven from each region) will be in Indianapolis on Thursday and Friday this week for the second of three two-day workshops with experts in the field and leaders from other cities with similar experiences. Each of the three cities are hosting an academy workshop, focusing on the particular specifics of that city while also learning valuable lessons that are applicable back home. The participants will also take a trip together to a fourth region that already has tasted the kind of success that these leaders would love to replicate.

Would you like to follow along and hear some of the great insights participants are picking up in this week’s Indianapolis workshop? Follow @t4america, @TransitCtr and the hashtag #TranspoAcademy on Thursday May 14 and Friday May 15.

Key business leaders from each region are part of each group, along with mayors and city/county council members, real estate pros, housing industry experts and local advocates.

The diverse group of members, assembled by each region’s team lead, recognizes the fact that making any big plan to invest in a new transit line or system requires buy-in from more than just a mayor and/or a few citizen groups. There has to be a shared vision with support from a wide range of civic players. In some regions, there might be a huge university presence. In others, it might be a big medical institution that anchors the local economy.

In all cases, getting everyone to the table and building a vision that everyone can share in are keys to success.

In Indianapolis, the host of this week’s workshop, action by the Indiana legislature and Governor Mike Pence cleared the way for metro Indianapolis counties to vote on funding a much-expanded public transportation network, with a major emphasis on bus rapid transit. Civic, elected and business leaders had been hard at work since 2009 producing an ambitious and inspiring IndyConnect plan, “the most comprehensive transportation plan — created with the most public input — our region has ever seen,” according to Mayor Greg Ballard in the foreword to our Innovative MPO report. Now the hard part comes as they build public and political will and decide what to include on a November 2016 ballot measure.

While transit expansion has more support in the region’s core, local leaders acknowledge they have an uphill battle in some suburban counties more skeptical of the merits of transit. Mayor Ballard and the diverse group of Indy businesses (including higher education, healthcare and IT industries) supporting IndyConnect understand how important this measure is for helping Indy be economically competitive in the future. Local leaders hope to position their city to attract young families and to lure recent college grads back home to Indy. And a strong regional public transit system is lies at the core of their economic strategy.

“Supported by a strong business community, an ambitious heartland city wins the ability to let citizens decide their own transportation future.” Read our detailed “can-do” profile of Indianapolis.

After watching the region’s two other counties approve ballot measure to raise funds for a regional transit system originally envisioned by all three counties, the hosts of the first workshop in March in Raleigh (Wake County) hope to join the other two core metro counties in beginning a new regional rail transit system.

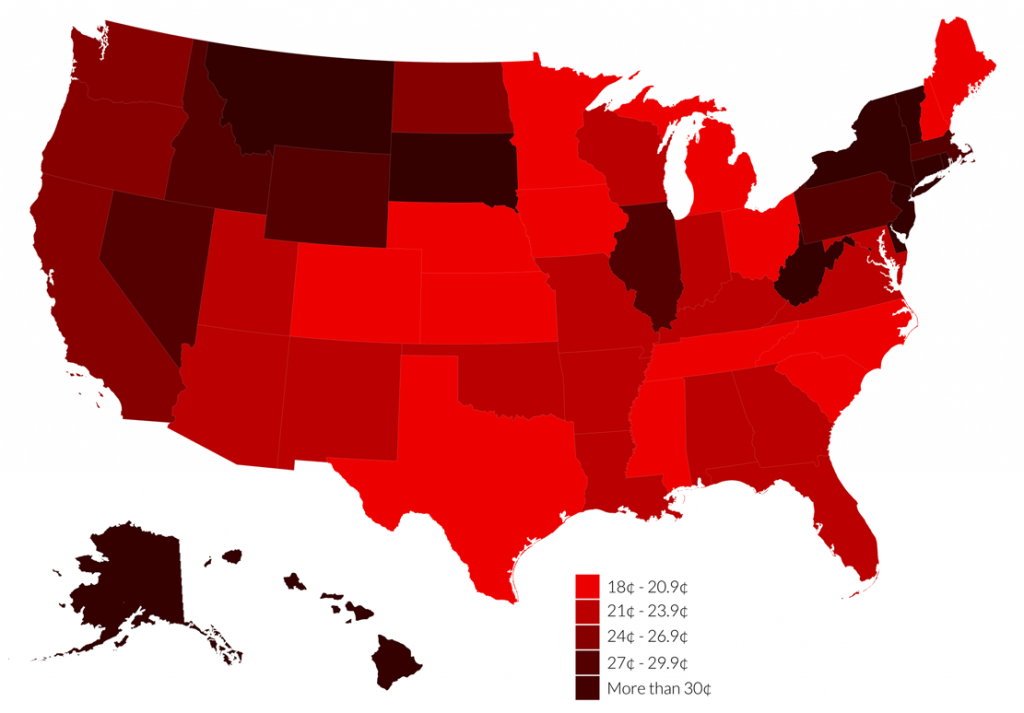

Adjoining Durham and Orange counties approved half-cent sales taxes in 2011 and 2012 to fund transit operations, improved bus service and a regional light rail line. Wake County Commissioners, meanwhile, had not allowed a question to raise funds for a regional transit system to go to the ballot. In fact, a handful of commissioners actively prevented the issue going forward, often stifling debate at times.

That could all change in 2015, as more than half of the county board was replaced last November. Four new supportive members replaced four who had consistently been on the other side of the issue, clearing the way for a potential ballot measure in Wake County. Raleigh Mayor Nancy McFarlane, who helped kick things off in the workshop this morning, has long supported a regional plan for transit.

Wake County is one of the fastest growing counties in the U.S. and the county’s population is due to double by 2035. Yet this rapidly growing community with a notable high-tech, research, government and major university employers is one of the few major metro regions lacking a significant transit system. Just like Indianapolis, they will be crafting their plan and building consensus in 2015 as they shoot for a vote in 2016.

In Nashville, local advocates and elected leaders are still smarting from the setback on last year’s effort to kick-start a bus rapid-transit network with a line that would have connected neighborhoods and major employment centers along an east-west route through the city.

Inspired by watching and learning from some of their neighbors’ mistakes, the Nashville Area Chamber of Commerce chose transit as a top priority six years ago, second only to improving public education. Local leaders there, including the recently departed Mayor Karl Dean, wanted to get out in front of the issue, rather than waiting 10 years after gridlock has overtaken the booming region. The business community and the Nashville Area Metropolitan Planning Organization have both been a key part of crafting the plan to make bus rapid transit a reality in Nashville, and members of the MPO, the Chamber, a and several businesses are all represented in their academy group.

Along with TransitCenter, we’re excited to see what the year will bring for these 21 participants and the up-and-coming regions that they represent. We’re going to have much more on these three cities this year, so stay tuned.