Academics have long pointed to a metric called destination access—called by Transportation for America “access to jobs and services”—as a better decision guide than older, conventional measures that focus mainly on the speed of cars. But what does this new practice look like in real life, and where and how is it already being used?

A man loading a bike onto a bus in Arlington, VA. Photo from the Arlington Department of Environmental Services.

It’s “Connecting people to jobs and services week” here at Transportation for America, so Eric Sundquist, the director of our partner organization the State Smart Transportation Initiative, wrote this blog post explaining how measuring access actually works.

When we measure destination access, which takes into account distance of travel as well as speed, we can better assess how easily travelers can reach their desired destinations. And we can make predictions about how people will choose to travel. It’s long been a better theoretical way to measure success, but the data has been expensive and it’s largely remained the purview of academics.

Now destination access has broken out of the ivory tower.

Newly available “big data,” much of it collected for use by GPS navigation software and devices—think Apple or Google Maps—has made measuring destination access possible in practice.

Created by a 2014 bill that “revolutioniz[ed] the way transportation projects are selected,” according to then-Governor Terry McCauliffe, the Virginia DOT has been using destination access to help make investment decisions through three rounds of transportation project funding.

How does this new system work in Virginia? VDOT assesses a wide range of projects together—highways, transit, walking, biking and demand-management projects—based on how they improve access to jobs and other common destinations, such as shopping, schools, and restaurants. After calculating destination access, VDOT then divides by cost of the project to the state, so that small, rural projects can compete with massive urban ones. In essence VDOT scores projects on destination access per dollar of investment, and this has led to a major shift in which projects they fund each year, increasing the benefits for each dollar invested.

For example, Virginia recently scored a project near the small town of Hopewell that would connect two regional bike-walk trails using a shuttle bus across a highway bridge with minimal shoulders and no sidewalks. The project scored modestly on destination access, but because it would cost only $44,000—very little by transportation infrastructure standards—it ranked first in its district and ninth out of 433 projects statewide. This is the type of small but vital project that can lose out when state agencies are so heavily focused on simply improving vehicle speed and avoiding delay.

Because we can use all this data to assess destination access across auto, transit, walking, biking modes, we can also combine those scores to predict how changes to the built environment will affect outcomes, such as mode share. Will a project lead to more or less driving, transit ridership or active transportation? Using destination access helps us make these forecasts.

More examples of measuring access to jobs and services

Working with the State Smart Transportation Initiative (SSTI), for example, the City of Eau Claire, WI., recently used destination access to assess transit investment options, including bolstering the city’s downtown circulator, extending service to future development sites, and pairing those investments with strategic transit-oriented development (TOD). The analysis not only let Eau Claire decision-makers understand the relative benefits of different transit expansions—including which residents would be affected and how much their access to jobs and other destinations would increase—but also showed that TOD could provide considerably larger benefits, compared to transit investments alone. This information will inform the city’s new transit plan and its recently announced climate goals.

This new method can be used to evaluate how proposed transportation projects would impact access to jobs and services, but it can also help local leaders envision potential future scenarios as they make broader long-term plans for both transportation and land use.

In nearby La Crosse, WI, the city leaned on destination access metrics to estimate the effects of various development scenarios. If the city directed new development to three proposed sites near downtown, would it reduce the need for auto travel and boost transit ridership? The SSTI analysis found that the answer was yes, a result that city officials will employ going forward in transportation and land use decision-making.

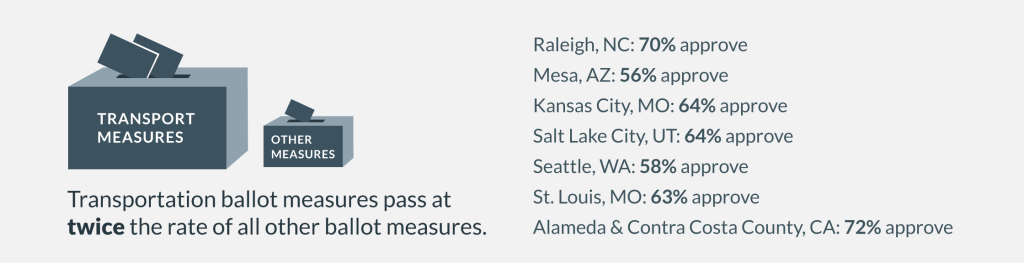

Ten years ago, we never would have been able to orient federal transportation spending around the goal of improving access to jobs and services. The data and other resources just weren’t there yet. But now, as both states and localities across the country take giant steps to prove that it’s not only possible but a smarter way to choose where and how to invest in transportation, it’s time for Congress to respond by making this a priority.