At a time when other cities are redesigning their bus transit service and aggressively investing overall in public transportation to provide more consistent, predictable service to serve residents and employers, Baltimore — thanks to the state of Maryland — is attempting to get the most out of its bus system with only marginal new investment and changes in service that won’t do much to improve access to jobs, schools, or opportunity.

MTA Route 3 bus on Cathedral at West Franklin Street in Baltimore. Flickr photo by Elvert Barnes.

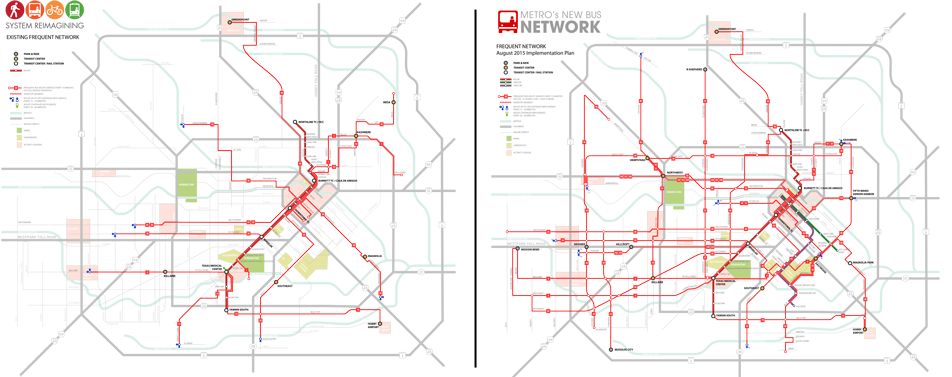

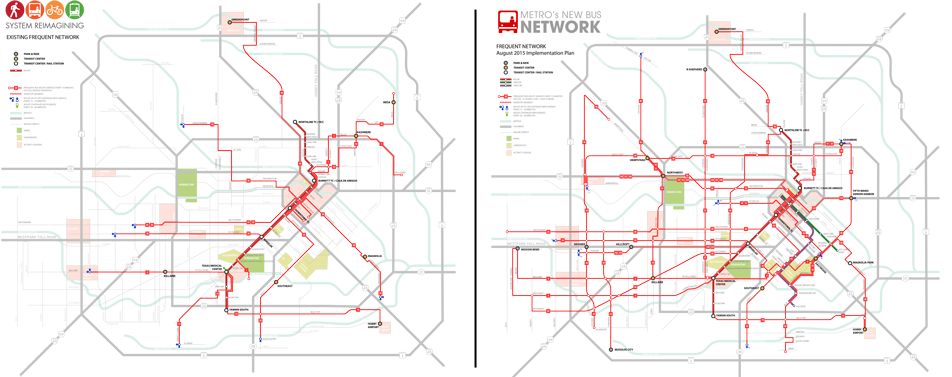

One of the most widely read transportation stories of the past few years is the dramatic transformation of Houston’s public transportation system, made possible by completely rebuilding their bus network and re-launching in 2015. As CityLab’s Laura Bliss wrote earlier this year:

The old hub-and-spoke system that had for decades funneled commuters downtown was straightened into a grid that cross-cuts the sprawling city, with fewer redundancies, more frequent service, and all-day, all-week service on heavily used lines.

For no substantial increases in operational costs, Houston was able to redesign their system to connect one million people and jobs with high-frequency all-day service. Paired with an expansion of light rail, it’s brought a significant increase in both ridership and the access that their residents have to jobs and opportunity.

The map of Houston’s frequent bus service, before (and after) their 2015 network redesign.

Meanwhile, halfway across the country in the summer of 2015, another story was unfolding.

That summer, Maryland Governor Larry Hogan canceled Baltimore’s long anticipated Red Line rail project that would have created a powerful new high-capacity transit line through the city. It would have connected jobs at Bayview (Johns Hopkins Bayview, National Institutes of Health), Woodlawn (Social Security Administration, Centers for Medicare and Medicaid Services) and the downtown office core with scores of residential neighborhoods all along the line — including some of the West Baltimore neighborhoods that would benefit the most from the investment and connection to opportunity that a new transit line provides.

A rendering of a station on the proposed Red Line in Baltimore, canceled in 2015 by Governor Hogan.

With many in Baltimore still reeling, just a few months later, Gov. Hogan’s administration released BaltimoreLink, “a transformative new vision for the future of transit in Baltimore City.” It was billed as a $135 million investment to rework Baltimore’s transit service, but those numbers are a little deceiving, as you’ll see.

The city and region’s transit is planned and operated by the Maryland Transit Administration (MTA), a state agency. No Baltimore agencies are in the driver’s seat of their own transit system, and have surprisingly few avenues for oversight and accountability of the MTA-run system.

Assessing the state’s proposal

Back in the fall, T4America helped the Central Maryland Transportation Alliance (Transportation Alliance), a coalition that supports improving and expanding transportation options in the Baltimore region, perform a quantitative analysis on the plan to see if the numbers would bear out on the benefits the state was claiming. Would the plan improve access to jobs, schools, and healthy food?

After all, in principle, a major reworking of the bus system map to improve service was a goal long-sought by the advocates in Baltimore. Once the MTA launched the BaltimoreLink effort it became the goal of advocates to challenge the MTA to produce measurable improvements on key indicators.

On behalf of the Transportation Alliance, we performed an analysis of the change in accessibility under the new plan. Using Citilabs’ Sugar Access tool, we measured the change in access at the individual block level, looking at access to all jobs, as well as access to high-opportunity jobs and access from low-opportunity neighborhoods. We also looked at access to public middle and high schools and grocery stores.

So would it be truly transformative? Would it increase the number of jobs that are accessible to everyday Baltimore residents? Would it provide increased connections to opportunity for a wider range of people?

The short answer is no.

A man studying while on on MTA Route 3 bus on North Charles at Centre Street in Baltimore. Flickr photo by Elvert Barnes

The long answer is that the plan “represents a missed opportunity to address regional goals in connecting households to jobs, schools, and essential services through transit,” according to the Transportation Alliance’s terrific summary of the findings. The bottom line is that BaltimoreLink does not deliver the promised transformational improvements and in contrast to MTA’s claims, we found a sharp decrease in accessibility on weekends (Sunday morning peak) and a marginal increase on weekdays. Read more about the detailed findings in the Transportation Alliance’s executive summary. (pdf)

In response, the administration initially attacked the empirical study, the Transportation Alliance and other local transit supporters. MTA recently released a revised plan which the Transportation Alliance and other stakeholders are reviewing. The MTA will hold public hearings in January, finalize the plan in March and implement the changes in June 2017.

Redeploying routes more effectively would be only one part of any proper solution. The region also needs local oversight in transit planning and an ironclad pledge for coordination between the state and the city to get anywhere near the kinds of benefit that Houston was able to realize. As the Transportation Alliance’s summary goes on to note:

Unlike Houston, Baltimore is an older, dense city where right-of-way is much more limited. Much of BaltimoreLink’s success in terms of speed and reliability hinges on coordination of road space and traffic signals between MTA and the City of Baltimore’s Department of Transportation. [But] without dedicated bus lanes and traffic signal prioritization, the potential benefits of this project may not be realized. It is inaccurate to anticipate reliable, rapid, transit going through downtown without dedicated right-of-way.

Looking ahead

While Baltimore stands to benefit immensely from redesigning its network, the benefits will be limited if the MTA merely reallocates its current resources — the state of Maryland needs to increase their investment in transit to improve service and accessibility for residents.

Click tor read our 2015 report analyzing the proposed economic benefits of the Red Line in Baltimore (and the approved Purple Line in the Washington, DC suburbs.)

In 2015, the city was on the cusp of going ahead with the Red Line, a brand new high-capacity rail transit line, which would have resulted in 83,000 more people living near high quality, frequent transit. Now, without that sizable (state and federal) investment represented by the Red Line, they’re on the receiving end of an alternate plan that represents just a 1.5 percent increase in MTA’s annual operating budget — about $70 million over six years; a plan that does little to separate transit riders from traffic congestion or tangibly improve access to jobs and opportunity.

That’s small potatoes, and the state needs to do better.

Maryland’s economic future is tied directly to the performance of their major metropolitan areas. Making smart investments that can increase access to opportunity for more people can help those places prosper, boosting the state’s overall economy in the meantime.

Houston it’s definitely not, but this story isn’t over yet.