In-demand and innovative transportation programs could face severe cuts come January due to an agreement made as part of the debt deal last year. But as a surprise to some, traditional highway programs funded mostly by the gas tax may be facing cuts as well.

Within the last-minute deal to raise the debt ceiling earlier this year, a proverbial doomsday device was put in the room with the supercommittee charged with coming up with the cuts needed to lower the deficit, in hopes of getting them to reach an agreement: Come up with the required cuts/revenue increases to hit the mark, or else hefty budget cuts of 8.2 percent across the board to discretionary programs would go into effect on January 1, 2013 and last for ten years. (The other half of automatic cuts would come from defense spending, with Social Security and Medicare/Medicaid almost entirely exempt.)

Because the supercommittee failed to reach an agreement, we’re facing hefty cuts in transportation spending for the next fiscal year. The heaviest burden will fall on the “discretionary” transportation programs that fund many important projects in high demand that aren’t typical highway projects: TIGER grants, New Starts transit construction, and even Amtrak.

Most of a state’s typical highway department budget comes from what’s known as formula programs, which everyone thought was protected until just recently.

Many states probably breathed a sigh of relief when the announcement was made that the programs funded by trust funds — like the Highway Trust Fund that comes from gas taxes and funds the formula grants to states — would be exempt from the cuts.

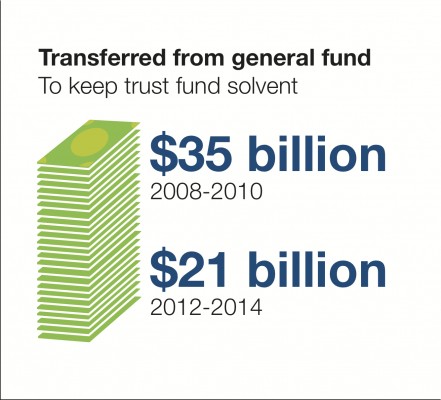

The problem with that, and what everyone seemed to forget, is that even the highway trust-fund formula programs are now getting huge infusions from general funds each year, making them susceptible to cuts. MAP-21, as you might remember, was only able to maintain the same funding level of the last transportation bill by cobbling together other sources of general funds, because the declining gas tax doesn’t raise enough revenue to cover spending — a structural financing problem for transportation that MAP-21 did not solve.

With about $20 billion in general fund revenues required to cover the difference in MAP-21 over its short life, that means formula programs will also face cuts this year. But discretionary programs will still take the brunt of the cuts (more than 7 percent), while the other highway formula programs get a haircut of only 1.3 percent.

Which means that the $500 million TIGER program takes a cut of $41 million. The almost-$2 billion New Starts program that funds all new transit construction is taking a $156 million cut — or about the entire cost of the soon-to-open 3.9-mile Tucson, Arizona Streetcar. Due to record ridership and sound management this year Amtrak asked for slightly reduced operations funding so they could plow the difference into capital expenses and improve the northeast corridor. Instead, Amtrak faces a cut of $116 million.

The only bit of good news — and there’s not much — is that transit formula programs (New Starts is discretionary) aren’t facing any cuts this year, because the transit account is still solvent and won’t be getting a general fund infusion this year. That changes next year, when transit would face cuts along with everything else.

Ultimately, though, the automatic “sequestration” cuts are really a bit of a black box, and there’s still a lot of confusion about what will and what won’t be cut. Even insiders within Congress or DOT aren’t sure exactly what will happen on January 1.

To avoid this massive mess our leaders in Congress need to find a way to stave off these automatic cuts and hopefully save the important transportation programs like TIGER that are funding many of the projects that have a hard time getting funding under old-school highway formulas. Whether there’ll be the political will to do that or not may be determined in large part by the November election.