As voters have been proving over and over during primary season this year, raising taxes or fees for transportation isn’t a political death sentence – no matter the party or political affiliation. In the past two weeks, Vermont, Massachusetts, and New Hampshire’s state legislators faced their first primary since voting to pass bills to raise additional state revenue for much needed transportation and infrastructure projects.

Vermont passed House Bill 510 in March 2013, to diversify their transportation revenue by introducing a 4 percent sales tax on the price of gas. This raises the overall gas tax by 7.5 cents, though it put a floor and a cap on the new sales tax portion so that Vermont drivers will never pay less than 13.4 cents per gallon or a maximum of 18 cents. H.B. 510 also authorized $10.38 billion in bonds.

“It was not an easy choice to move in this direction, and we didn’t make this decision lightly,” said House Transportation Chair Pat Brennan (R-Colchester) said at the time.“ We explored anywhere between 15 to 20 different funding options, and we ended right back here every time.”

The measure passed 128-42, with 18 Republicans and 104 Democrats voting “aye.” Of the 15 supportive Republicans who ran again, just one lost in the primaries on August 26th. Leigh Larocque (R-Barnet) lost to Marcia Robinson Martel. All of the 86 Democrats who supported the bill and ran for re-election won their primaries.

Massachusetts’ ambitious H3535, enacted in 2013, raised the gas tax 3 cents and indexed it to inflation, while also requiring the Massachusetts Department of Transportation and Massachusetts Bay Transportation Authority to raise a greater portion of their costs – up to an additional $229 million a year — through various avenues including tolls, fees, fares, and others.

In the heavily Democratic state, the bill passed 158-38, with 157 Democrats and just one Republican voting yes. All but one of the 133 supportive Democrats running for re-election won their primaries, with Rep. Wayne Matewsky (D-Everett) losing his seat to Joseph McGonagle, Jr.

(There is a footnote to these results in Massachusetts. A measure has been added to this year’s November’s ballot to reverse the legislation completely. One benefit of that is that, after these primaries, we’ll have another public referendum on raising transportation revenues put directly to the voters. It’s just one of many important ballot measures we’ll be keeping a close eye on here this November, so check back. – Ed.)

New Hampshire has a very similar story. In 2013, lawmakers approved Senate Bill 367, which increased the per gallon tax by 4 cents. The funds raised were dedicated to rehabilitation and bridge repair projects for the next two years. In the last version of our report on bridge conditions in 2013, New Hampshire had the eighth-worst bridges in the country, with 14.9% of all bridges rated structurally deficient. The bill also added bonds for the widening of Interstate 93.

The bill passed 208-150, with 186 Democrats and 22 Republicans voting in favor of upping the state’s investment in transportation. Just three of those supportive legislators running for re-election failed to keep their seats, meaning 98.13 percent kept their seats after supporting SB 367. 21 state legislators decided not to run for re-election for various reasons.

John Graham (R-Bedford), William O’Neil (D-Manchester), and Steven Briden (D-Exeter) lost their seats in Tuesday’s primary. As of this writing there is no indication that the transportation revenue vote was a primary culprit.

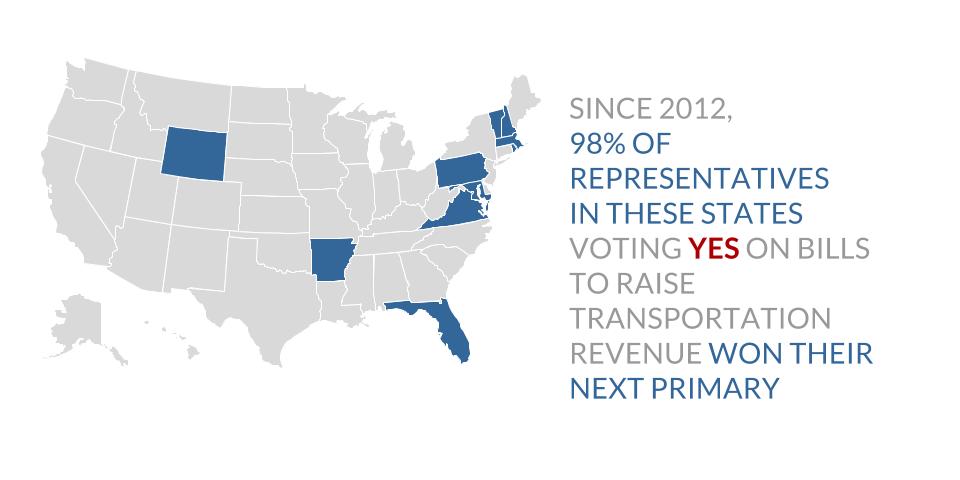

Among all states holding primaries after a transportation tax increase – these three plus Pennsylvania, Virginia, Maryland, and Wyoming – supportive legislators have kept their seats at a rate of 98 percent. Voters clearly have been rewarding their state legislators who are brave enough to make the hard decisions when it comes to funding transportation and infrastructure.

All of the primaries this season in the states that we’re following have occurred, so we’re wrapping up this series for now. But all of these results are chronicled in one place now on our website, along with our page tracking all of the considered and enacted state plans to raise transportation revenue.