With the strong support of Governor Matt Mead, Wyoming’s state legislature in 2013 voted overwhelmingly in favor of increasing the state gasoline tax by 10 cents per gallon. This marked the first increase in the gasoline tax in Wyoming since 1998. The increase was expected to raise around $72 million in the first year for Wyoming’s state and local roads.

Following Gov . Mead’s leadership, the solidly Republican House and Senate voted with nearly a two-thirds majority in support of the 10-cents per gallon gas tax increase. This strong showing followed an effective campaign by a business and trade association coalition that demonstrated the need for new revenues, and the Wyoming Department of Transportation (WYDOT) demonstrating a growing shortfall.

The governor began making the case by laying out a long-term plan for highway maintenance. He argued that fuel taxes are one of the least expensive and fairest ways for Wyoming citizens to pay for highways and roads. He rejected an alternative proposal for a $50 million infusion from the general fund, arguing that the state need long-term, dedicated funding for transportation:

“Every part of Wyoming’s economy relies on an effective, well-maintained and continually improved highway system. WYDOT projects are planned years into the future — good planning, reasonable costs and effective management can only be achieved through reliable, long-term funding.”

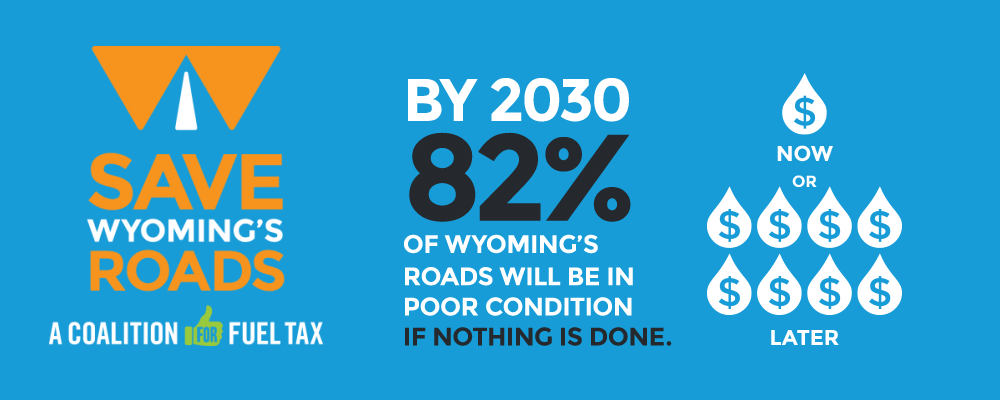

Several coalitions of businesses and associations came together to push the state legislature to act. Online efforts, such as savewyomingroads.com, and advertisements urged Wyoming residents to get behind the increase and to reach out to state legislators in support. The associations and coalitions involved in these efforts included:

- Wyoming Lodging and Restaurant Association

- Wyoming Petroleum Marketers Association

- Wyoming County Commissioners Association

- Wyoming Contractors Association

- Wyoming Mining Association

- Wyoming Travel Industry Coalition

- Wyoming Association of Realtors

- Johnson County Woolgrowers Association

- Wyoming Pathways (a statewide bicycling, walking and public land trail advocacy group)

Opponents of the measure included the Wyoming Farm Bureau Federation, National Federation of Independent Businesses, and Wyoming Freedom, a libertarian advocacy group. Though vocal, opponents lacked the broader coalition of those in favor of raising transportation revenue.

The campaigns for and against the gas tax increase came only after the governor made the fuel tax increase one of his major priorities, which the legislature took on and advanced with the passage of HB 69. The governor showed a commitment to the issue by declaring that he would seek an alternative means of funding transportation if the fuel tax was not raised. Advocates for the gas tax increase noted that Wyoming’s tax rate was lower than its neighbors, but because fuel costs were set regionally, the state was not seeing lower prices. Instead, Wyoming drivers were, in effect, subsidizing fuel prices in neighboring states.

Concerns over damaged infrastructure and a governor who directly and publicly pressed the importance and obligation of repairing roads and bridges helped to bring together legislators to pass a transportation revenue increase.

Campaign graphics courtesy of Warehouse Twenty One.