Scores of state legislatures are still in session or nearing the end of their sessions. With transportation funding and policy on the docket in scores of states, here’s a roundup of the progress being made in states working to create more transparency, build more public trust in transportation spending, and even raise new money.

Many state legislatures are in the crunch time of crossover days and committee deadlines. Many more are already taking the long view and looking ahead to big policy changes later this year or after the next election. Here’s a roundup of the top stories:

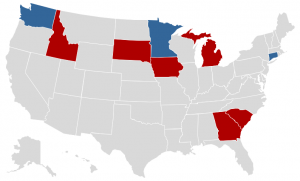

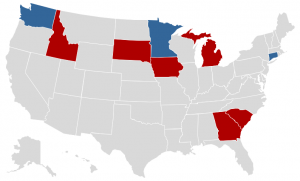

![]() Our refreshed state policy bill tracker is the best way to keep tabs on the most current information about these states attempting to raise new funding in 2016, states attempting to reform how those dollars are spent and states taking unfortunate steps in the wrong direction on policy — all tracked in three separate searchable, sortable tables of that information.

Our refreshed state policy bill tracker is the best way to keep tabs on the most current information about these states attempting to raise new funding in 2016, states attempting to reform how those dollars are spent and states taking unfortunate steps in the wrong direction on policy — all tracked in three separate searchable, sortable tables of that information.

In addition, our hub for state policy and funding related resources includes all past and current reports, bill trackers, and other state-focused resources.

LOCAL FUNDING

After an up-and-down last few years when it comes to transportation funding, the Georgia state legislature successfully passed a pared-back bill last week that will allow voters in the City of Atlanta to decide the question of raising new funds for expanded transit service throughout the city, in addition to other transportation investments in the city.

A similar bill (SB 313) earlier this year would have allowed all counties served by MARTA to raise sales taxes for transit, but that one stalled due to opposition from outside the city. We wrote about the new alternative compromise package last week after its passage:

The legislation (SB 369) enables three new local funding sources, each dependent on approval through voter referenda. 1) The City of Atlanta can request voter approval for an additional half-cent sales tax through 2057 explicitly for transit, bringing in an estimated $2.5 billion for MARTA transit. 2) Through a separate ballot question the city could ask for another half-cent for road projects. 3) And in Fulton County outside the city, mayors will need to agree to a package of road and transit projects and ask voters to approve up to a ¾-cent sales tax to fund the projects.

The bill passed the House 159-4 on March 16 and passed the Senate last week, on the last day of the session.

While empowering local voters to raise new local funds is a step forward, the Georgia legislature also took a step back last week, passing a bill that requires a successful voter referendum before any county can spend money on fixed-guideway transit projects. Georgia doesn’t require a similar hurdle for highway projects. This bill (SB 420) exempts current MARTA service areas, the Beltline and the Atlanta streetcar, but it would slow down planned bus rapid transit projects in Cobb County in suburban Atlanta.

Support is building in Massachusetts for a proposal introduced by Rep. Chris Walsh (D-Framingham), a START network member, to enable cities and towns to raise local taxes to fund transportation projects with approval through voter referenda. See some of the supportive arguments for Massachusetts’ bill here and here. T4America provided a national perspective and supported the bill at legislative briefing earlier this month at the capitol. Also briefing legislators was Mayor Greg Ballard, former mayor of Indianapolis, a region that recently gained legislative approval to raise local taxes for transit projects. Ballard provided lessons learned from his efforts at the state capitol and preparation for an expected ballot question this fall.

We support efforts to produce and pass state legislation to increase transportation funding, advance innovation and policy reform, empower local leaders and ensure accountability and transparency through our State Transportation Advocacy, Research & Training (START) Network of state and local elected officials, advocates and civic leaders. Join the START network today.

STATE FUNDING

Louisiana legislators just ended a special session on the budget without a comprehensive or long-term plan to fully close the state’s structural budget deficit. With more red ink looming in the state’s general budget, efforts to raise new revenue for the transportation fund face long odds.

Looking past the budget deficit, new Gov. John Bel Edwards (D) identified new Baton Rouge-to-New Orleans rail service as a priority, vowing to do “everything he could” to get new trains rolling.

Connecticut’s transportation committee advanced a “lockbox” provision (HJ 1) to dedicate certain revenue only for transportation projects. Republicans warn they will still oppose the measure unless the wording is tightened to prevent any diversion of money from the state’s special transportation fund. Constitutionally dedicating revenue from fuel taxes, vehicle fees, and a portion of the gas tax is seen as a necessary prerequisite to raising these taxes to bring in new money for transportation. While there is bipartisan support, at least in principle, a measure earlier this year failed to reach the necessary supermajority when a bloc of Republican House members said the measure would not go far enough in dedicating transportation dollars.

Gov. Dannel Malloy (D) called for big investments in all modes across the state in the 30-year, Let’s Go CT plan. But adding a new lane in each direction on I-95 across the state, one of the biggest and most expensive projects on the list, is drawing substantial opposition. Opponents note that a new lane will do little to ease traffic or advance the state’s 21st century knowledge economy. The state DOT counters that their plan for new capacity coupled with dynamic management through new electronic tolling would cut down on “induced demand” by making it more expensive, and so less desirable, for new drivers to fill new space on the roads.

A proposal in the Mississippi Senate to raise transportation taxes or issue bonds to fund road projects (SB 2921) was kept alive, but just barely. A procedural move allows negotiations to continue and may allow a last-minute agreement on the issue later in the session.

Minnesota’s legislature is in the fourth week of a short session that must conclude May 23. In that time, legislators will need to find $135 million for the next phase of the Twin Cities’ light rail system — or risk losing $895 million in federal funding and drastically setting back the planned project. Twin Cities local governments are expecting the state to do its part — they’ve already directed $118 million in local funding into the project. Transportation funding was a top issue in last year’s legislative session and members are again looking for a compromise to get more state funding— possibly including new revenue — to roads, bridges, and transit.

STATE REFORM

The Maryland House passed two bills to add objective scoring to the way the state DOT selects projects (HB 1013) and to create a new board to give local oversight over the state transit agency (HB 1010). Both measures are still being revised in the Senate; they must pass both chambers by the time the session ends on April 11th.

MOVING BACKWARD

Tennessee’s bill that would restrict gas tax receipts for any bicycle or pedestrian projects may be losing steam. The bill (HB 1650/SB 1716) was slowly making progress in the House, but this week the House delayed a hearing and the Senate scheduled a hearing for the bill on the last day of the session – a common way to signal the bill will not be passing this year.

FUNDING & POLICY TRACKER

You can access the full list of funding bills being considered and policies we are tracking throughout the country at our tracker here. As always, get in touch if there are bills you are working on that we should have our eyes on.

While their speeches are notable for their willingness to take a stand on the issue, these governors (and many state legislators) are stepping out on the issue because states face growing needs and static or falling revenues from state as well as federal sources.

While their speeches are notable for their willingness to take a stand on the issue, these governors (and many state legislators) are stepping out on the issue because states face growing needs and static or falling revenues from state as well as federal sources.