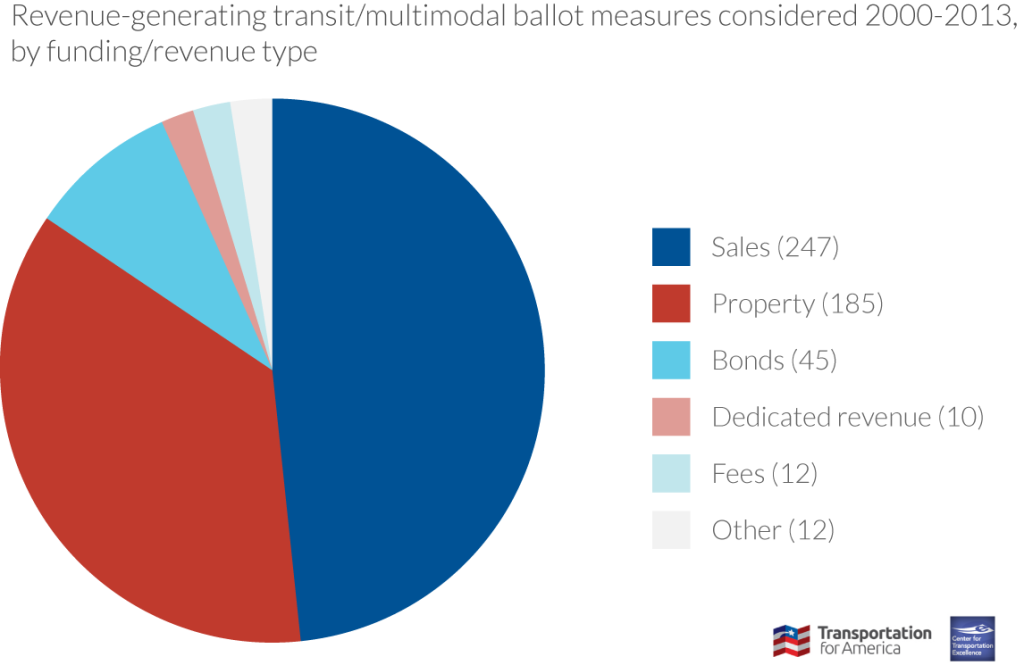

All local ballot measures considered from 2000 to 2013, by funding type

Some states have been far more active than others at the ballot box. This first map shows the number of ballot measures attempted that would raise revenue for either transit or multimodal uses, from 2000-2013. The following six maps show the same data, broken up by the revenue type for those measures over the same period. The pie chart at the bottom shows the share of all measures over the same period for each funding type. Data from the Center for Transportation Excellence.

Click a tab

* Dedicated revenue refers to measures that would dedicate existing funds or revenue streams to transportation

![]()

- This is the last map — take me back to the first map: Local funding legislation considered or enacted at the state level 2013-14

Details on funding types:

- Sales Tax: local option sales tax authorized at municipal or county level

- Property Tax: municipal or county level authority to levy property taxes & ballot measures required in some jurisdictions

- Vehicle Fees: local option vehicle registration tax or fee authorized that typically require ballot measure

- Dedicated Revenue: dedicated revenue refers to measures committing existing general funds towards transportation-specific purposes

- Bonding: local authority for general obligation bond ballot measures

- Other: misc. ballot measures including motor vehicle excise tax, hotel bed tax, and transit oriented development (TOD) loan program