The benefits of transit investments reach communities from coast to coast

Public dollars devoted to making capital improvements to public transportation systems support thousands of manufacturing jobs, in communities small and large, in nearly every state across the country.

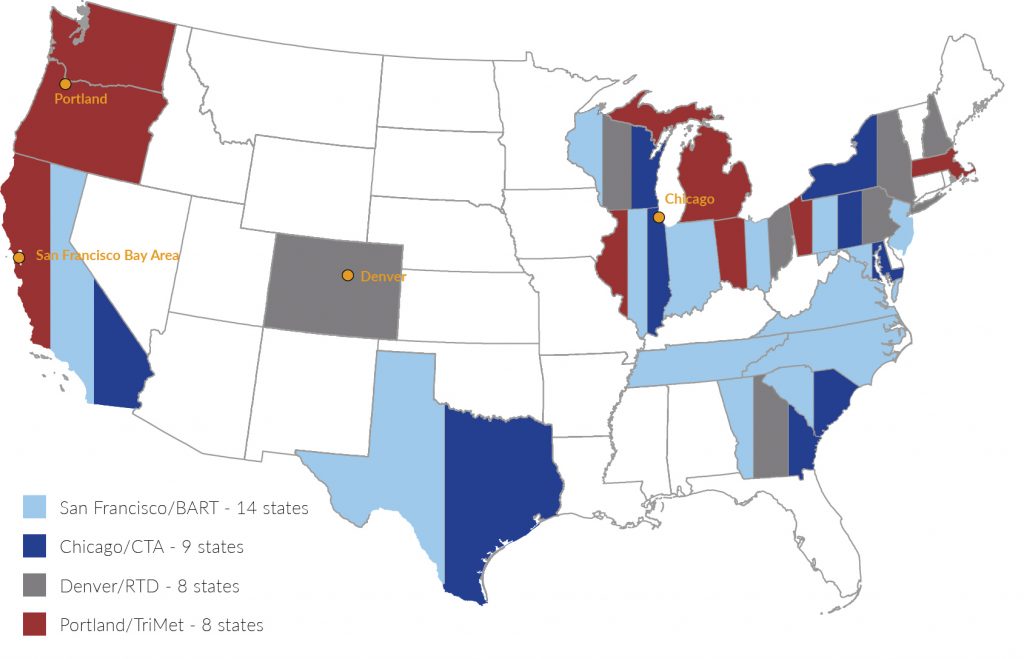

The supply chain for public transportation is as deep as it is wide, touching every corner of the country and employing thousands of Americans who produce everything from tracks, to seats, windows, communications equipment, wheels and everything else in between. As just a snapshot, recent capital improvements made in just four transit systems — San Francisco, Denver, Chicago, and Portland — supported jobs in 21 states.

Heavy cuts to federal transit spending, as proposed by Congress, would have a devastating effect on these local businesses and the tens of thousands of jobs they support. Without continued federal support, transit projects underway could stall, new or planned projects would be postponed or canceled, and transit agencies would scale back or cancel orders of new railcars or buses. The factories and suppliers that produce or manufacture components for transit systems would have to downsize or shutter without a steady pipeline of projects.

To preserve these jobs and support main streets from coast to coast, Congress and the administration should support and fund the Transit Capital Investment Grants (CIG) Program at or above FAST Act levels of $2.3 billion each year.

View and download a sharable one-page fact sheet Download this full paper (pdf)

Visit our home for all materials related to federal transit funding: t4america.org/transit

Stats

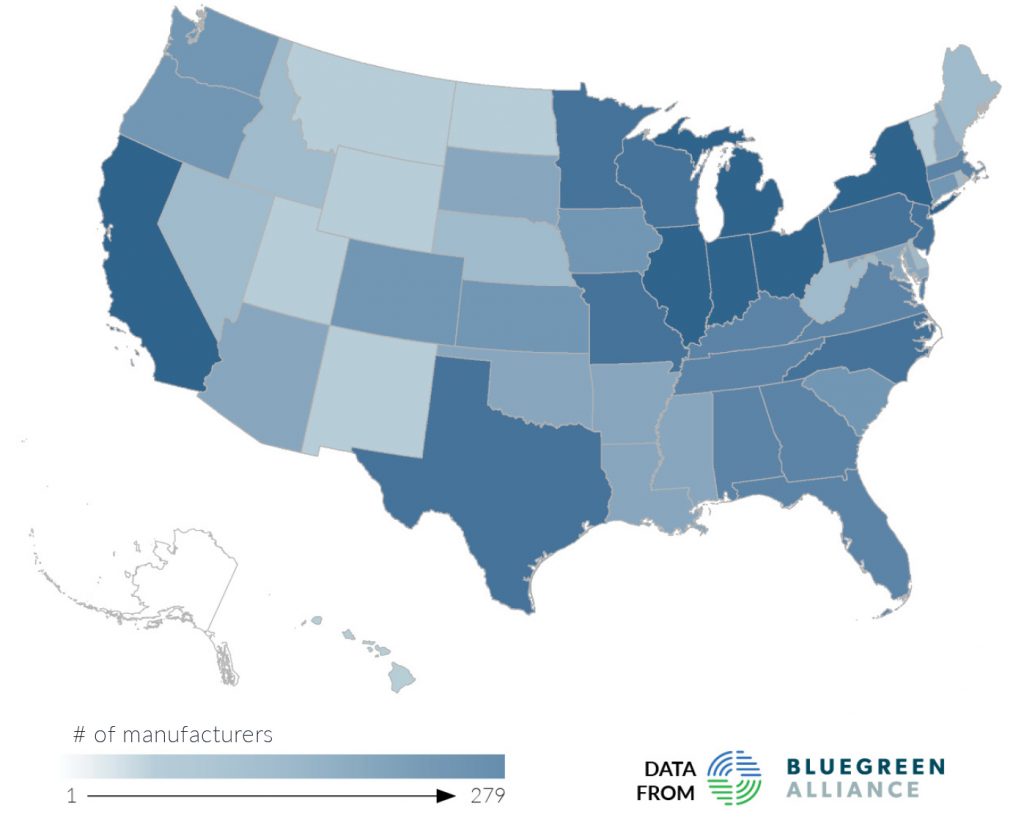

There are at least 2,763 transit component manufacturers in the United States.

91 percent [396 of 435] of congressional districts host at least 1 manufacturer.

98 percent [50 of 51] states + DC are home to at least one manufacturer.

Where are these jobs located?

See which states/districts have the most transit manufacturing jobs in the tables below and download a sharable fact sheet that’s tailored to share with your senator(s) or representative.

| Rank | State | Representative | # of manufacturers | Download a fact sheet |

|---|---|---|---|---|

| 1 | IN-02 | Rep. Walorski | 59 | Indiana (pdf) |

| 2 | MI-11 | Rep. Trott | 58 | Michigan (pdf) |

| 3 | IL-08 | Rep. Krishnamoorthi | 52 | Illinois (pdf) |

| 4 | WI-05 | Rep. Sensenbrenner | 32 | Wisconsin (pdf) |

| 5 | IN-03 | Rep. Banks | 27 | Indiana (pdf) |

| 6 | IL-05 | Rep. Quigley | 25 | Illinois (pdf) |

| 6 | IN-07 | Rep. Carson | 25 | Indiana (pdf) |

| 6 | IL-17 | Rep. Bustos | 25 | Illinois (pdf) |

| 9 | WI-06 | Rep. Grothman | 23 | Wisconsin (pdf) |

| 9 | OH-14 | Rep. Joyce | 23 | Ohio (pdf) |

| Rank | State | Senators | # of manufacturers | Download a fact sheet |

|---|---|---|---|---|

| 1 | IL | Sens. Durbin & Duckworth | 279 | Illinois (pdf) |

| 2 | OH | Sens. Brown & Portman | 211 | Ohio (pdf) |

| 3 | MI | Sens. Stabenow & Peters | 196 | Michigan (pdf) |

| 4 | CA | Sens. Feinstein & Harris | 195 | California (pdf) |

| 5 | IN | Sens. Donnelly & Young | 193 | Indiana (pdf) |

| 6 | NY | Sens. Schumer & Gillibrand | 156 | New York (pdf) |

| 7 | PA | Sens. Casey & Toomey | 148 | Pennsylvania (pdf) |

| 8 | WI | Sens. Johnson & Baldwin | 137 | Wisconsin (pdf) |

| 9 | TX | Sens. Cornyn & Cruz | 126 | Texas (pdf) |

| 10 | MO | Sens. McCaskill & Blunt | 80 | Missouri (pdf) |

Transit construction supports jobs nationwide

More than two thousand manufacturing facilities and companies, spread across 49 states, are tied directly to the manufacture or supply of new transit systems and repairs and upgrades to existing systems. This supply chain employs tens of thousands of workers assembling transit vehicles, manufacturing components and electronics, and building infrastructure.

Investment in transit creates tens of thousands of jobs

According to research by the American Public Transportation Association, every billion dollars invested in transit capital (construction, rehabs, and upgrades) supports more than 15,000 jobs, including good-paying manufacturing and machining jobs.

Recent transit capital projects have supported jobs in numerous states all across the country

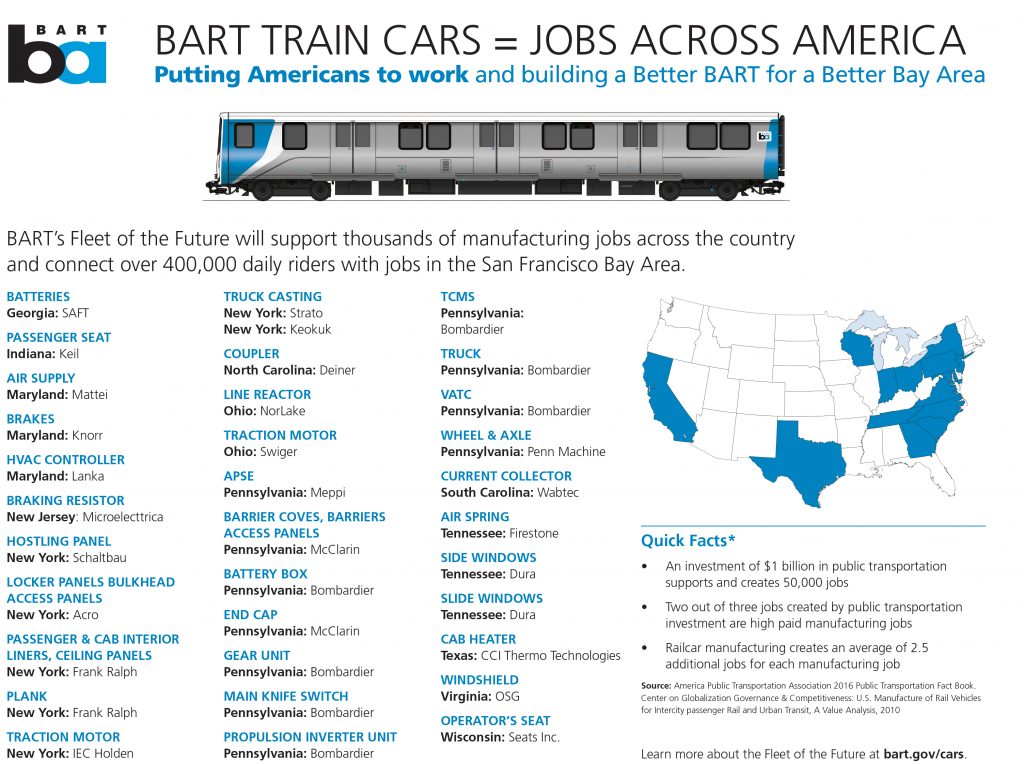

While the majority of all transit rides may take place in major metropolitan areas, the benefits of transit investments ripple far beyond, to communities large and small, from coast to coast. Recent capital upgrades on just four transit systems — the San Francisco Bay Area’s BART, Denver’s RTD, Chicago’s CTA, and Portland’s TriMet — have supported or are supporting jobs in 21 states.

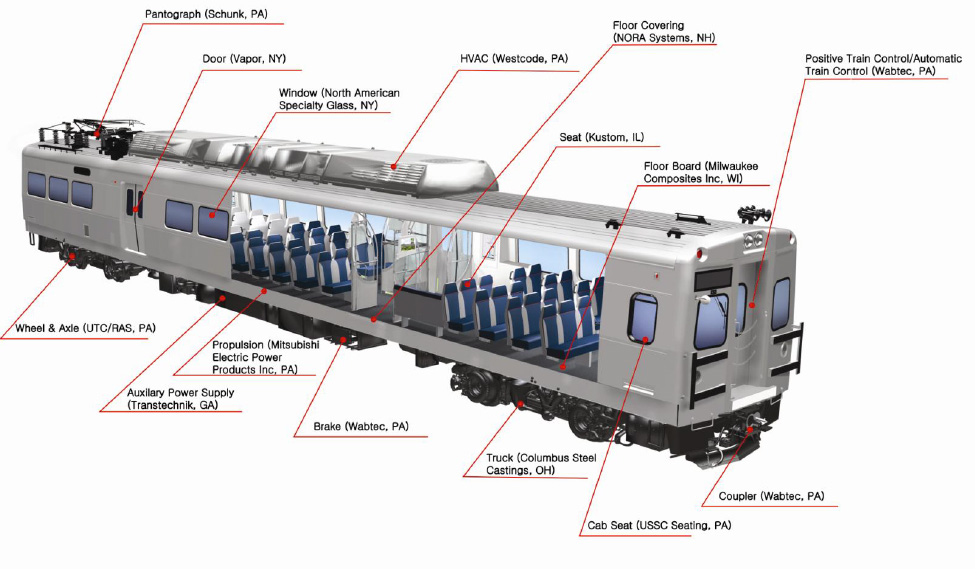

Transit construction depends on hundreds of components and suppliers

Each investment in transit capital construction (or repairs and upgrades to existing transit systems) spurs business at dozens of individual companies and factories, potentially thousands of miles away. For example, rail cars built for new commuter rail service in the Denver region include dozens of components. And new rail cars being built to upgrade the Bay Area’s subway fleet include parts from more than thirty suppliers located in thirteen states.

Capital Investment Grant program creates manufacturing jobs

Through the transit Capital Investment Grant program the federal government matches state and local funds to invest in new transit systems or make major upgrades to expand system capacity. This is the primary way that the federal government supports local communities that want to improve or expand their transit networks.

Federal transit capital funds are generally matched at least one-to-one with non-federal funds, making this program particularly effective at leveraging additional funding. When big cities like San Francisco or Chicago invest their own dollars into transit projects alongside federal dollars, they support jobs in the transit supply chain throughout the country.

The pipeline of transit projects in various stages of development awaiting federal grants for construction includes approximately 50 projects in 19 states. This pipeline means reliable business for the transit supply chain and allows companies to open specialized manufacturing facilities, keep workers employed, and have some measure of confidence that their business has the potential for more work in the future.

Buy America provision keeps jobs at home

Buy America provisions for federal transit funds mandate that more than 60 percent of components and subcomponents are manufactured in the United States. These investments directly support American manufacturing jobs. A steady pipeline of federally funded projects encourages foreign manufacturers to set up new manufacturing sites in the U.S. and hire American workers.

Cuts to federal transit funding would destroy jobs

Cuts to the federal programs would have a devastating effect on these suppliers and the tens of thousands of jobs they support. Without continued federal support, projects underway would stall and communities would have to delay plans to invest their own funds in transit. Many of these communities awaiting federal grants have already raised their own money via tax increases or ballot measures and are ready to place orders that would be filled by factories and suppliers tailored to serve this industry — employers that may have to downsize or shutter without a steady, predictable pipeline of transit projects.

A closer look at three transit manufacturers

New Flyer

New Flyer is the largest bus manufacturer in North America, employing more than 4,000 workers in the United States. The company’s footprint includes 31 manufacturing, assembly, distribution and service facilities in North America, including facilities in thirteen states.

The company’s growing business serving public transit agencies across the country is closely tied to steady and predictable federal funding. Ninety percent of the company’s $2 billion in annual business comes from public transit agencies. Federal grants make up some share of the funding for nearly all of those purchases and almost none of the agencies would be able to make their purchases of new buses with local funding alone.

New Flyer delivered 877 buses to transit agencies across the country in the third quarter of 2017 and projects to manufacture 3,800 buses in fiscal year 2017. The company has outstanding orders and options for more than 10,000 buses. In the transit industry, new buses are paid for on delivery, so while New Flyer has a two-year backlog of orders and options, it will only be able to keep completing orders if transit agencies have the federal funding they have expected and budgeted for.

The 87-year old, publicly traded company is headquartered in Winnipeg, Canada but approximately three quarters of its workforce is based in the United States. New Flyer’s buses are assembled at three major assembly plants, in St. Cloud and Crookston, Minnesota and Anniston, Alabama, and are built with more than 60 percent U.S.-made components, meeting Buy America standards.

The Anniston facility is the site of the brand new Vehicle Innovation Center opened in October 2017. The $4 million facility will allow the company to lead the development of new vehicle technologies to serve the future needs of the public transit industry.

“This center will lead development of the future of transit technology, including autonomous driving and electric systems … and it’s all designed and developed right here in Anniston,” said Wayne Joseph, President of New Flyer’s Transit Bus Business, at the ribbon cutting event for the new facility. “We look forward to making a positive impact on the community and on innovation and jobs.”

Automated Railroad Maintenance Systems (ARMS)

ARMS produces power, train control, signaling, communications systems and electronics for public transit, passenger, and freight railroads across the country.

Their current public transit and intercity passenger rail contracts total approximately $7 million, accounting for 20 percent of all business at their sole facility in O’Fallon, MO. The company has been based in the St. Louis region for thirty years.

ARMS’s transit customers depend on federal funding for major new construction projects “From what we understand there is about $6 billion in federal funding that goes into various transit programs. That’s the main life-blood of this industry,” said Mike Monaco, VP of passenger sales. “Obviously, any kind of reduction of federal funding would be a big factor.”

Monaco estimates that if federal funding for new transit construction were cut, their business would have to cut back by 15 to 20 percent, likely requiring reductions in staff.

Cleveland Track Material

Cleveland Track Material manufactures rail tracks and components, supplying transit agencies and railroads in the U.S., Canada, and Mexico. The company employs 150 at its Cleveland, OH, headquarters, where it was founded in 1984. The company employs an additional 45 people in Memphis, TN, at a facility operated since 1994, and 30 workers in its Reading, PA facility opened in 2007.

Approximately 40 percent of Cleveland Track Material’s business comes from contracts to supply public transit systems.

Of all the factors facing the company, “declining funding would have the biggest impact,” said Sandy Reik, Sales Coordinator, who has been with the company for more than twenty years.