For several years, Indianapolis government officials and many in the metro region’s business community have identified an improved public transit network as critical to growing the region’s economy and strengthening its competitiveness. In 2014, after three years of debate and false starts, the Indiana state legislature finally granted the region authority to put transit funding to a vote.

Indianapolis Mayor Greg Ballard, a Republican, had made a compelling case that in order to attract business and keep young people from leaving the state, the metro region needed a 21st-century public transportation network. Compared to other metropolitan regions, Indianapolis lags far behind at 84th for number of buses, 71st for vehicle hours in service, and 92nd for the number of passenger trips. As Mayor Ballard said:

“Today, our cities face a much different transportation need — one of connecting people to each other and unique experiences. New urban dwellers want to be connected to their neighborhood and their city through means other than a car. … The battle for the future of American cities will be won by the place that attracts and retains talent.”

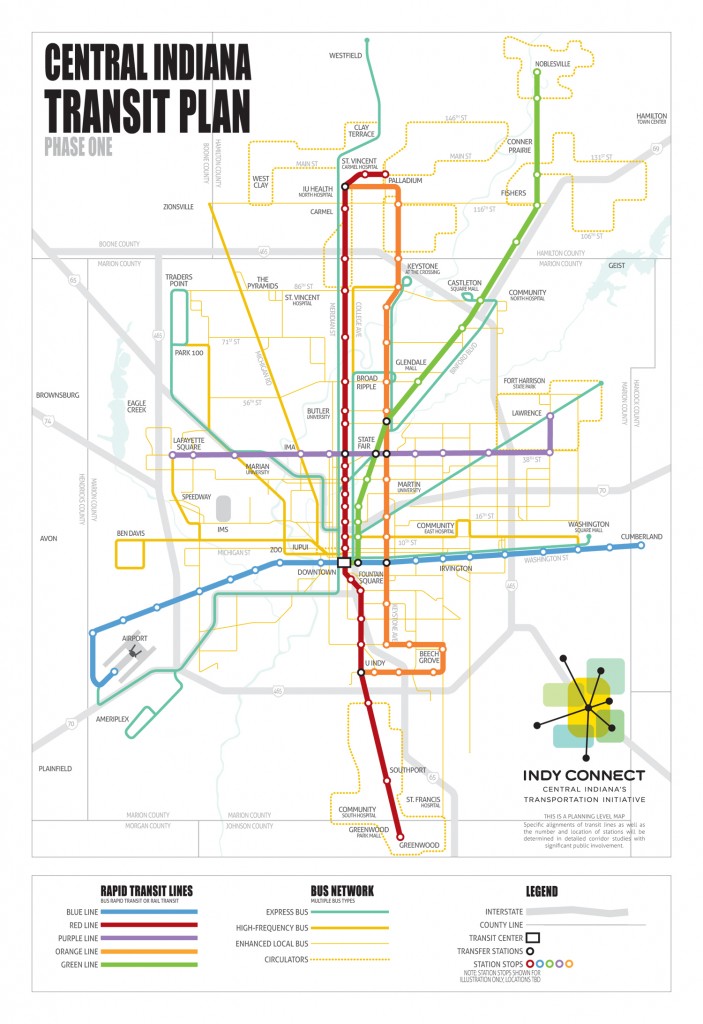

Over the past 25 years, the Indianapolis metropolitan region has created multiple plans for expanding bus service, but not until recently was there a comprehensive strategy to improve transit service in the region. The comprehensive plan, known as Indy Connect, is designed to provide residents access to a multimodal transportation network of bus routes, rapid transit lines, walking and biking paths and roadways.

Inhibiting the region’s ability to put the plan into action is the lack of a dedicated revenue source for transit. The first step in addressing this challenge was convincing the state legislature to give the six-county Indianapolis region the authority to advance a ballot measure to raise revenues for Indy Connect through an increase in local taxes. In Indiana there is no local sales tax option and a constitutional cap on property taxes. While the region already had authority to raise local income taxes for public safety, state legislation was required to allow their proposal to increase local income tax rates by between 0.1 and 0.25 percent and devote the additional revenue dedicated to transit.

For three years supporters of Indy Connect made the case to the state legislature to give them this authority. Progress was slow: In 2012, the legislation never made it out of committee. In 2013 the legislation made it out of the House, but was stuck in a Senate study committee. To advance the legislation, supporters of Indy Connect adopted a very broad advocacy strategy, communicating the importance of local control and decision-making to legislators from across the state. Recognizing the conservative bent of the legislature, the diverse coalition of supporters framed their messaging around local empowerment and the economic benefits of transit: better access to jobs, healthcare, education, and cultural events; increased potential for Indianapolis to access and retain jobs and talent; neighborhood growth, and reduced regional congestion. The coalition in support of Indy Connect included business (e.g., Indy Chamber of Commerce), environmental, labor, healthcare, higher education, religious organizations, and AARP.

Supporters had to counter the national conservative group Americans for Prosperity (AFP), which also was working in the legislature. While AFP and its like-minded supporters were effective in convincing some members, the legislature voted in early 2014 in support of the legislation by about a two-thirds majority in the House and Senate.

Signed into law by Republican Governor Mike Pence, the legislation gives authority to the six counties in the Indianapolis region to increase local income tax rates by up to 0.25 percent and dedicate the revenue to transit — except for rail transit — if approved by a county voter referendum. The legislation also allows adjoining municipalities to increase taxes and join the transit district by local referendum if the county-wide vote in their county fails. The legislation also requires that 25 percent of the transit system’s revenue come from fares and 10 percent from business contributions through a nonprofit organization.

This legislation is a significant step in empowering local communities in the Indianapolis region to work with their residents to develop and invest in the transportation solution that is right for them.