Update on 17 states moving to raise money for transportation

From Washington to South Carolina, 17 state legislatures (with others likely to follow) are debating plans to raise new revenue for transportation after a decade in which their primary funding sources shrank and federal support became increasingly uncertain. See the current state of play in our freshly updated national roundup. (Updated 2/25/15)

Among those 17 states, Iowa, Georgia, and Washington have been in the news over the last two weeks due to significant progress made toward producing a funding package in their state legislatures.

In Washington, a (still contentious) plan currently before the full Senate would raise the gas tax by a total of 11.7 cents per gallon by 2018. In Iowa, Gov. Terry Branstad just signaled that he would likely support a ten-cent increase in the state gas tax if the legislature can come together to pass one and send it to his desk for approval. In Georgia, the House Transportation Committee passed a bill to replace the state’s sales tax on gasoline with a 29.2 cents per gallon tax and give counties more authority to tax gasoline; floor debate has been postponed while supporters work to round up votes.

Update: Iowa’s package passed both House and Senate on Tuesday afternoon. Link. -Ed.

Most states rely heavily on their taxes on gasoline and diesel fuel to provide their share of transportation budgets, and those sources have taken a hit as vehicles have become more efficient, per-person driving mileage has declined and construction costs rise along with inflation — the same forces that have been squeezing federal funding and the 18.4 cents-per-gallon gas tax. Unchanged since 1993, the federal gas tax has lost approximately one-third of its purchasing power. In 2012, Congress did something it had not done in decades, passing a federal transportation law that failed to increase funding. In 2014, Congress punted on a long-term solution, scouring the couch cushions once again to scrape together enough funding to keep the program hobbling along until May 2015.

Even if Congress comes through, the aging infrastructure in need of repair in many states and the demands coming from demographic and economic changes mean states need more revenue, not less. (And yes, many states also need to dramatically reform how they spend the dollars that they have, which can go a long way toward building the public confidence required to successfully taxpayers for additional money.)

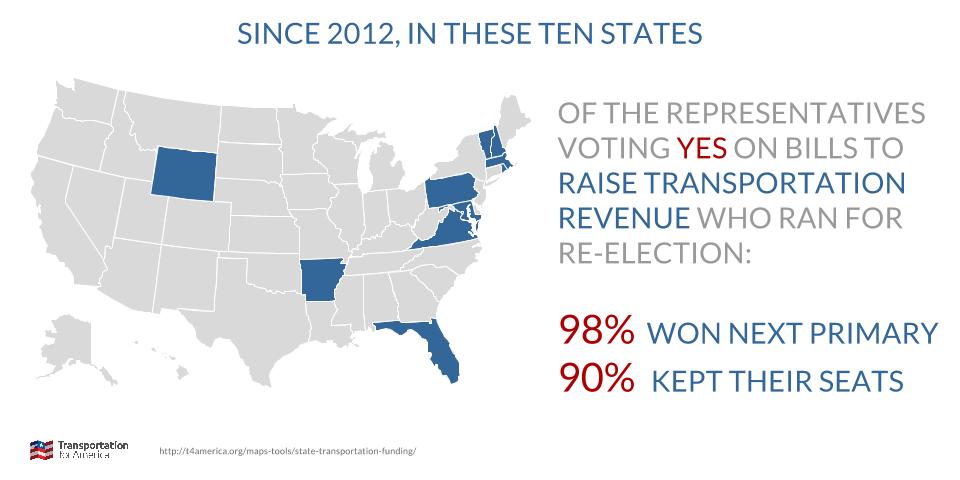

One key lesson worth noting up front that we shared yesterday: Legislators who supported such moves have met with little to no pushback at the polls. Our updated analysis of November’s election data should be instructive for the legislators currently weighing action: 90 percent of legislators supporting revenue increases in ten states since 2012 won their re-election bids.

We’ll be following the action in these states closely and likely adding more to the list, so stay tuned.